INSURANCE

american life insurance american classic myga annuity

When securing your financial future, understanding the options available is key. American Life Insurance stands out as a trustworthy provider in the annuity market, offering innovative products designed for peace of mind and long-term stability. Among their offerings, the American Classic MYGA Annuity shines brightly. This multi-year guaranteed annuity promises consistent growth and allows you to plan effectively for retirement or other life goals. Curious about how this product can fit into your financial strategy? Let’s dive deeper into what makes the American Classic MYGA Annuity an appealing choice for many investors seeking security and predictability in uncertain times.

Overview of Annuities and MYGA (Multi-Year Guaranteed Annuity)

Annuities are financial products designed to provide a steady stream of income, often used for retirement planning. They come in various forms and serve different purposes based on individual needs.

A Multi-Year Guaranteed Annuity (MYGA) is one popular type. It offers fixed interest rates over a specified term, typically ranging from three to ten years. This predictability can be particularly appealing for those seeking stability in their investment.

Investors make an initial lump-sum payment and receive guaranteed returns throughout the contract period. At the end of this term, they can either withdraw their funds or roll them into another annuity product.

This structured approach minimizes risk while providing assurance against market volatility. MYGAs can help individuals plan effectively for long-term goals with confidence and clarity around potential earnings.

Benefits of Investing in a MYGA Annuity from American Life Insurance

Investing in a MYGA annuity from American Life Insurance offers several attractive benefits. First and foremost, it provides a guaranteed return over multiple years. This stability can be particularly appealing for those seeking predictable income.

Another advantage is the tax-deferred growth potential. Your earnings accumulate without immediate taxation, allowing your investment to grow at an accelerated pace until withdrawal.

Additionally, with the American Classic MYGA annuity, you enjoy flexibility in terms of contribution amounts and durations. You can tailor your plan to fit your financial goals seamlessly.

Safety is also paramount; these products are backed by strong insurance company guarantees. This means your principal remains secure even during market fluctuations.

Having access to various payout options empowers you to choose how and when you’d like to receive funds—further enhancing its appeal as part of a well-rounded retirement strategy.

How the American Classic MYGA Annuity Works

The American Classic MYGA annuity operates on a straightforward concept. When you invest your money, you enter into a multi-year contract with American Life Insurance. This means your funds are secured for a predetermined period.

During this time, you enjoy guaranteed interest rates that remain fixed. This stability offers peace of mind in an ever-changing financial landscape. You won’t have to worry about market fluctuations affecting your returns.

At the end of the term, you can choose from various options for accessing your funds, including lump-sum withdrawals or rolling over into another product. There’s flexibility built into the plan to accommodate different financial strategies.

Moreover, during the accumulation phase, tax-deferred growth is a significant advantage. You don’t pay taxes on earnings until withdrawal, allowing more substantial growth potential over time without immediate tax implications.

Comparison with Other Annuity Options

When comparing the American Classic MYGA annuity to other options, clarity is key. Traditional fixed annuities offer steady interest but typically lack the multi-year guarantee that MYGAs provide.

Variable annuities can be appealing with their potential for higher returns through market investments. However, they also come with significant risks and uncertainties. This could lead to fluctuations in your income which some investors prefer to avoid.

Indexed annuities link growth to a stock market index, balancing between risk and reward. While they may seem attractive, understanding their caps and participation rates is essential before diving in.

The American Classic MYGA stands out by offering straightforward guarantees without complex terms or hidden fees. It simplifies financial planning while ensuring peace of mind regarding future income streams. The choice ultimately depends on individual preferences and risk tolerance levels.

Considerations Before Investing in a MYGA Annuity

Before diving into a MYGA annuity, it’s vital to consider your financial goals. Know what you want out of the investment. Are you looking for steady income or growth? Understanding your objectives will guide your decision.

Liquidity is another key factor. MYGAs typically have surrender periods during which accessing funds may incur penalties. If you anticipate needing quick access to cash, this could be an issue.

Evaluate interest rates and terms as well. While MYGAs offer guaranteed returns over several years, market fluctuations can impact overall performance in the long run.

Assessing fees associated with the annuity is crucial too. Some products might come with hidden costs that erode potential gains.

Consider how a MYGA fits into your broader retirement strategy. It should complement other investments rather than serve as the sole solution for securing your future finances.

Conclusion: Why American Life Insurance’s MYGA Annuity is

The American Classic MYGA Annuity from American Life Insurance stands out as a solid choice for those seeking a reliable investment option. With the security of fixed returns over multiple years, it offers peace of mind and financial stability. This product is particularly appealing to conservative investors who prioritize safety in their retirement savings.

The benefits are clear: tax-deferred growth, predictable income streams, and protection against market volatility make it an attractive alternative to traditional investments. The flexibility that comes with choosing your term length also plays in its favour, allowing you to align your investment strategy with your personal retirement goals.

When considering this annuity, think about how it fits within your overall financial plan. It’s essential to evaluate factors such as liquidity needs and time horizons before committing. Still, for many individuals looking for a straightforward way to secure their future finances, the MYGA Annuity could be just what they need.

With its reputable backing by American Life Insurance and the structure designed specifically for long-term stability in mind, exploring this option may lead you toward achieving greater financial confidence during retirement years ahead.

INSURANCE

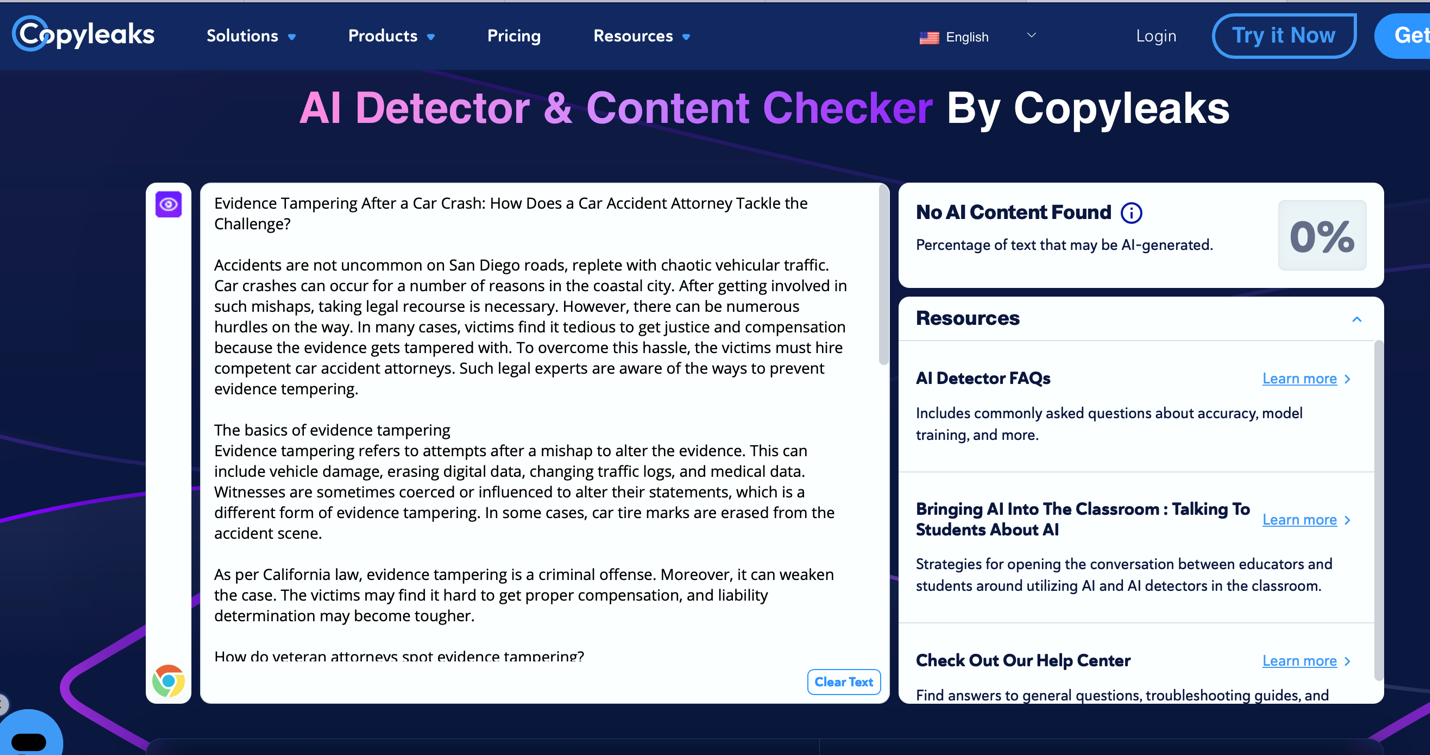

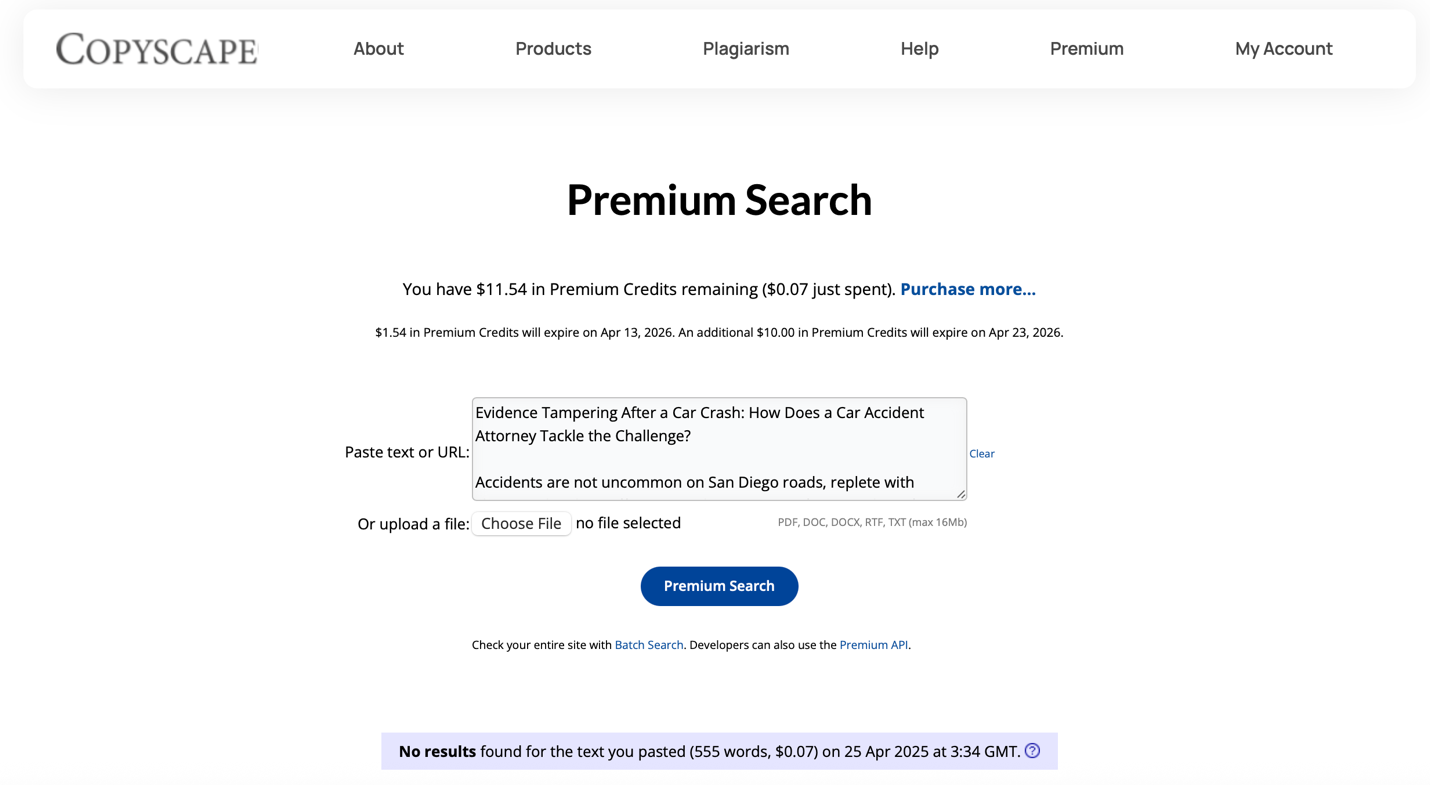

Evidence Tampering After a Car Crash: How Does a Car Accident Attorney Tackle the Challenge?

Accidents are not uncommon on San Diego roads, replete with chaotic vehicular traffic. Car crashes can occur for a number of reasons in the coastal city. After getting involved in such mishaps, taking legal recourse is necessary. However, there can be numerous hurdles on the way. In many cases, victims find it tedious to get justice and compensation because the evidence gets tampered with. To overcome this hassle, the victims must hire competent car accident attorneys. Such legal experts are aware of the ways to prevent evidence tempering.

The basics of evidence tampering

Evidence tampering refers to attempts after a mishap to alter the evidence. This can include vehicle damage, erasing digital data, changing traffic logs, and medical data. Witnesses are sometimes coerced or influenced to alter their statements, which is a different form of evidence tampering. In some cases, car tire marks are erased from the accident scene.

As per California law, evidence tampering is a criminal offense. Moreover, it can weaken the case. The victims may find it hard to get proper compensation, and liability determination may become tougher.

How do veteran attorneys spot evidence tampering?

Veteran car accident attorneys are capable of spotting inconsistencies in such cases. They look for the following issues when investigating such cases:

- Discrepancy in statements collected from the eyewitnesses.

- Conflicting statements from the car drivers.

- Dashcam and CCTV footage that looks questionable.

- Disappearance of accident signs like skid marks from the accident spot.

Not every attorney is capable of analyzing such finer nuances when dealing with such cases. To find trusted and veteran attorneys to handle such cases, one can explore https://hhjtrialattorneys.com/san-diego-car-accident-lawyer/.

Tactics used by ace legal experts to handle evidence tampering

Seasoned car accident attorneys’ resort to various tried and tested strategies to reduce the risk of evidence tampering.

- They try to gather as much evidence as possible from the accident spot and the witnesses. They gather recorded digital evidence and keep a copy. These include CCTV and surveillance clips, images of the cars involved in the mishap, and footage, if available.

- When such legal experts feel some evidenc’e may have been eliminated or tampered with, they resort to advanced digital technologies. For example, the absence of tire marks and video clips may make it hard to decipher which car lost control and rammed into other vehicles. These attorneys team up with crash reconstruction experts and AI technology specialists to develop an accident simulation.

- These attorneys rely on different types of records, such as car GPS data and mobile call logs of the drivers, to develop their cases and overcome inadequate evidenc’e issues.

- To reduce the scope of witnesses changing their versions and forgetting key details related to the crash, such legal experts interrogate them without delay.

Even when direct evidence is scarce, such legal expert may use sold circumstantial evidenc’e like phone record time stamps to prove their points.

Final words

One should contact veteran attorneys soon after the mishap to ensure the evidence does not get erased or tampered with after an accident. The sooner an expert attorney can investigate the case, the better it is for evidence collection and development. Of course, assessing such legal experts is necessary before choosing them.

INSURANCE

How to Deal with the Insurance Company After a Car Accident

No one expects to be in a car accident. But when it happens, the aftermath can feel overwhelming. Dealing with injuries and financial losses can be hard, especially in expensive cities like Philadelphia, where the cost of living is 5% more than the national average. Between dealing with injuries, vehicle repairs, and emotional stress, the last thing you want is to struggle with insurance companies. Yet, that’s exactly what many accident victims in Philadelphia face.

Insurance companies are businesses. Their goal is to minimize payouts while making it seem like they’re helping you. This is where having the right approach matters. Knowing how to communicate with them can make a significant difference. Consulting a car accident lawyer in Philadelphia can ensure you don’t settle for less than you deserve.

Let’s break down the steps you should take when dealing with insurance companies after an accident.

Notify Your Insurance Provider Immediately

The first step is simple: report the accident to your insurer as soon as possible. Most policies require prompt notification. Delaying this could lead to complications with your claim.

When you make this call, stick to the basic facts. Tell them where and when the accident happened but avoid admitting fault or speculating about details. Anything you say can be used to reduce or deny your claim.

Be Cautious When Speaking to the Other Party’s Insurer

If the other driver’s insurance company contacts you, proceed with caution. Their representatives might seem friendly, but their job is to protect their company’s interests.

Here’s what you should keep in mind:

- You are not required to give a recorded statement.

- Avoid discussing injuries until you’ve seen a doctor. Some symptoms take time to appear.

- If you’re uncertain, direct them to your attorney or let them know you’ll respond in writing.

Document Everything Thoroughly

Strong evidence strengthens your claim. Gather and keep the following:

- Photos of the accident scene, vehicle damage, and injuries.

- Medical records detailing your treatment.

- A copy of the police report.

- Witness statements, if available.

Keeping a journal of how the accident affects your daily life can also be useful. Pain, mobility issues, emotional distress—these details could support your claim for fair compensation.

Don’t Rush Into a Settlement

Insurance companies often offer quick settlements. While it may seem tempting, these offers are usually much lower than what you actually need to cover medical bills, lost wages, and other damages.

Before accepting anything, consider:

- Have all injuries been fully treated?

- Are future medical expenses accounted for?

- Will this compensation truly cover all financial losses?

If there’s any doubt, seek legal advice before signing anything. Once you accept a settlement, you can’t ask for more later.

Get Legal Help if Needed

If the claims process becomes frustrating or if the insurance company is unfairly denying your claim, you don’t have to handle it alone. An experienced car accident lawyer can negotiate on your behalf and ensure your rights are protected.

Legal professionals understand the tactics insurance companies use. With their help, you stand a much better chance of receiving the compensation you deserve.

Final Thoughts

Dealing with insurance companies after a car accident isn’t easy, but being informed can make a world of difference. Stick to the facts, document everything, and don’t let them pressure you into settling too soon. If things get complicated, seeking legal guidance is always a smart move.

Your health and financial well-being should always come first. Stay patient, stay cautious, and make sure you get the support you need.

INSURANCE

Factors That Increase the Value of a Car Accident Claim

Car accidents can be a traumatic experience. Dealing with the legal aftermath can be even more stressful. People may be waiting to receive fair compensation to recover their losses. They should know there are some factors that can help increase the value of their car accident claim.

This article discusses everything that increases the total value of car accident compensation. If you are still unsure, you can contact Rawlins Law Accident & Injury Attorneys, who specialize in helping accident victims to ensure they receive maximum compensation.

Severity of Injuries and Medical Treatment

Your compensation depends on the injuries you experience during the accident. The worth of settlements increases dramatically if injuries surpass a specific threshold because of various combined factors.

- Comprehensive Medical Documentation: Medical documentation from healthcare professionals functions as verified evidence that shows your injuries. Detailed medical documentation serves as an essential requirement.

- Treatment Consistency:Medical advice from your doctor needs to be followed continuously to prove that your injuries exist. Insurance adjusters search for periods without medical care as a basis to prove your injuries are less serious than you describe. Your condition becomes clearer through regular doctor visits and proper therapy implementation.

- Long-term Impact: Claims for permanent disabilities together with scarring along with chronic pain typically receive greater compensation amounts. The inability to work alongside the loss of ability to enjoy life or perform daily activities creates higher claim value because these substantial life changes need appropriate financial support.

Liability Evidence and Documentation

The strength of evidence supporting the other driver’s fault directly impacts your claim value.

- Clear Fault Determination:Clear fault leads to increased payouts. The presentation of complete evidence through police reports and witness statements, together with photographs from accident scenes, provides unambiguous proof of responsibility, thus shielding your compensation from insurance company attempts to reduce payouts by attributing joint liability.

- Professional Accident Investigation:Experienced investigators use their expertise to discover important information that investigators without their background might fail to observe. Professional examination of accidents by reconstruction specialists allows you to build stronger evidence that lawyers can use for negotiation purposes.

Insurance Coverage Considerations

Available insurance coverage sets practical limits on potential compensation.

- Policy Limits: Owners of insurance policies define the highest compensation level that their carriers can provide. Serious claims require analyzing all potential insurance benefits as well as using the homeowner’s underinsured motorist coverage amount.

- Bad Faith Practices:Insurance companies must carry out their duties with complete honesty and fairness according to legal requirements. Your overall settlement amount may grow if insurance companies violate their duty to handle claims properly because this behavior could lead to bad faith penalties.

- Legal Representation Quality: Insurance claims succeed more often when victims work with attorneys who possess experience in this field.

- Negotiation Skills:Lawyers who possess insurance claims knowledge stand against insurance companies that try to offer low settlement amounts. Your compensation will be appropriate because your attorney uses their knowledge of similar cases and settlement patterns to stand for fair compensation.

Trial Experience

The presence of attorneys who have demonstrated trial competence gives insurance companies an additional reason to settle claims outside the courtroom. The risk of trial preparation convinces insurance companies to pay better settlements to cases. Your claim results significantly improve with proper legal counsel.

Conclusion

Identifying the main elements affecting claim value will enable you to develop proactive strategies when facing post-accident situations. Proper documentation, consistent medical treatment, and qualified legal representation are your most powerful tools for maximizing compensation.

-

TECHNOLOGY2 years ago

TECHNOLOGY2 years agoElevating Game Day Eats: A Guide to Crafting Crowd-Pleasing Sliders

-

ENTERTAINMENT2 years ago

ENTERTAINMENT2 years agowave_of_happy_: Your Ultimate Guide

-

FASHION2 years ago

FASHION2 years agoGPMsign Fashion: Redefining Style with Purpose

-

TECHNOLOGY2 years ago

TECHNOLOGY2 years agoTrader Joe’s Dayforce: Revolutionizing Workforce Management

-

FOOD2 years ago

FOOD2 years agoAltador Cup Food Court Background: A Culinary Extravaganza Unveiled

-

SPORTS2 years ago

SPORTS2 years agoScore Chaser Sporting Clays: A Thrilling Pursuit of Precision

-

HOME IMPROVEMENT1 year ago

HOME IMPROVEMENT1 year agoWhat Kitchen Renovation Companies Offer Beyond Basic Remodeling

-

NEWS2 years ago

NEWS2 years agoNyl2 Kemono: Unveiling the World