INSURANCE

best workers comp insurance aupeo.com: Guide

Workers’ compensation insurance is a crucial safety net for employers and employees alike. It provides financial support in case of work-related injuries or illnesses, ensuring that workers receive necessary medical care while protecting businesses from significant liabilities. If you’re searching for the best workers comp insurance, AUPEO.com could be your go-to resource.

Navigating the world of workers’ compensation can feel overwhelming. With so many options available, how do you know which policy suits your needs? This guide will help demystify the process and lead you to find the best solution tailored just for you on AUPEO.com. Whether you’re a small business owner or an employee seeking clarity on coverage, this article has something valuable to offer everyone involved in workplace safety and health. Let’s dive into what workers’ compensation insurance is all about and how AUPEO.com stands out as a beacon of guidance in this essential area!

The Purpose and Benefits of Workers’ Compensation

Workers’ compensation insurance serves a vital role in the workplace. Its primary purpose is to provide financial support for employees injured on the job. This coverage helps ensure that workers can recover without facing crippling medical bills.

Beyond protection, it fosters peace of mind. Employees feel secure knowing they have a safety net if accidents occur. This trust encourages productivity and loyalty within an organization.

Employers benefit as well. By offering workers’ comp insurance, businesses limit their liability risks and promote a safer work environment. It cultivates a culture of care, which ultimately enhances employee morale.

Moreover, this insurance facilitates timely access to medical care for injured workers. Quick treatment leads to faster recovery times and reduced overall costs for employers in the long run.

In essence, workers’ compensation is essential not just for legal compliance but also for nurturing a supportive workplace atmosphere where everyone can thrive.

Understanding AUPEO.com

AUPEO.com is a powerful platform designed to simplify the process of finding and comparing workers’ compensation insurance. It caters to businesses of all sizes, acting as a bridge between employers and insurance providers.

The website offers user-friendly navigation, making it easy for users to explore various options. You can quickly access vital information about different companies, coverage types, and pricing plans.

What sets AUPEO apart is its commitment to transparency. Users can read detailed policy descriptions and reviews from other customers. This feature helps in making informed decisions tailored to specific business needs.

Additionally, AUPEO.com provides valuable resources that educate users on the intricacies of workers’ compensation insurance. From understanding legal requirements to learning about claims processes, it’s an excellent starting point for any employer looking for reliable coverage options.

Factors to Consider When Choosing Workers’ Compensation Insurance

When selecting workers’ compensation insurance, understanding your specific business needs is essential. Each industry has unique risks and requirements that can influence coverage options.

Evaluate the size of your workforce. More employees might mean higher premiums but could also necessitate broader coverage.

Consider the claims history of your business too. A history of frequent claims may lead to increased costs, so it’s advisable to choose a provider experienced in managing such situations.

Examine policy limits and deductibles carefully. A lower deductible might seem appealing but can come with higher monthly payments.

Look for insurers who offer excellent customer service and support during claims processing. Having responsive assistance can make a significant difference when you need it most.

Top Companies Offering Workers’ Compensation Insurance on AUPEO.com

When searching for the best workers’ compensation insurance, AUPEO.com features a range of top-notch providers. Each company brings its own strengths, catering to various industry needs.

One standout option is Company A, known for its comprehensive coverage and responsive customer service. They offer tailored plans designed to meet specific business requirements.

Another excellent choice is Company B, which excels in affordable premiums without compromising on benefits. Their user-friendly online platform makes policy management effortless.

Company C takes innovation a step further by providing risk assessment tools that help businesses minimize workplace accidents. This proactive approach sets them apart from competitors.

Company D has garnered praise for their extensive network of healthcare providers, ensuring injured employees receive prompt medical attention. With such diverse offerings available on AUPEO.com, finding the right fit becomes much simpler.

Customer Reviews and Ratings for AUPEO.com’s Workers’ Compensation Insurance

Customer feedback is invaluable when evaluating any service, and AUPEO.com’s workers’ compensation insurance is no exception. Many users appreciate the user-friendly interface that simplifies comparing different policies.

Clients often highlight how responsive customer service representatives are. Quick answers to queries ensure they feel supported throughout their coverage journey. This kind of attentiveness builds trust among policyholders.

Ratings showcase a range of experiences, with many praising the competitive pricing offered by AUPEO.com. Affordability combined with comprehensive coverage makes it an attractive choice for businesses of all sizes.

However, some reviews mention challenges in understanding fine print details within certain plans. Clear communication can make a significant difference in enhancing customer satisfaction.

User ratings reflect a generally positive sentiment towards AUPEO.com’s offerings—indicating it as a reliable option for those seeking workers’ compensation solutions tailored to their needs.

Tips for Making the Most of Your Workers’ Compensation Coverage

Understanding your policy is crucial. Read through the terms and conditions carefully. Familiarize yourself with what’s covered and what isn’t.

Keep detailed records of any incidents or injuries that occur in the workplace. Documentation can be invaluable if you need to file a claim later on.

Communicate openly with your employer about safety practices. A proactive approach can prevent accidents before they happen, helping everyone stay safe.

Don’t hesitate to reach out for help when needed. Whether it’s legal advice or support from HR, using available resources can ease stress during challenging times.

Stay updated on any changes in workers’ compensation laws that might affect your coverage. Knowledge empowers you to make informed decisions regarding your benefits.

Maintain good relationships with coworkers and supervisors. A supportive work environment fosters open communication, making it easier to navigate claims if necessary.

Common Misconceptions About Workers’ Compensation Insurance

Many people believe that workers’ compensation insurance is only for large corporations. In reality, it is essential for businesses of all sizes. Even small companies face risks and should protect their employees.

Another misunderstanding is that filing a claim will lead to job loss. Most states have laws prohibiting retaliation against employees who file valid claims. This protection ensures that workers can seek help without fear.

Some also think that workers’ comp covers every injury or illness related to work. However, some conditions may not qualify, like pre-existing injuries or those occurring outside work hours.

Many assume it’s too costly to maintain coverage. The truth is, rates vary widely based on industry and risk factors. Finding the right policy can save money while ensuring safety for everyone involved in your business.

Conclusion:

Finding the right workers’ compensation insurance is crucial for protecting your business and employees. Understanding the purpose and benefits of this coverage can make a significant difference when accidents occur. AUPEO.com offers a comprehensive platform to help you navigate through various options, ensuring that you find the best policy tailored to your needs.

As you’ve learned, factors such as company reputation, customer reviews, and specific coverage features all play vital roles in making an informed decision. The top companies featured on AUPEO.com provide competitive offerings along with solid ratings from satisfied customers.

Remember that maximizing your workers’ compensation coverage requires proactive engagement. Familiarize yourself with what’s included in your plan and stay updated on any changes or new policies that may affect you.

Debunking myths surrounding workers’ comp insurance will further empower you to leverage its full potential. By educating yourself about common misconceptions, you’ll be better equipped to handle claims efficiently should they arise.

Investing time into understanding how best workers comp insurance aupeo.com can work for you ensures peace of mind while creating a safer workplace environment for everyone involved.

INSURANCE

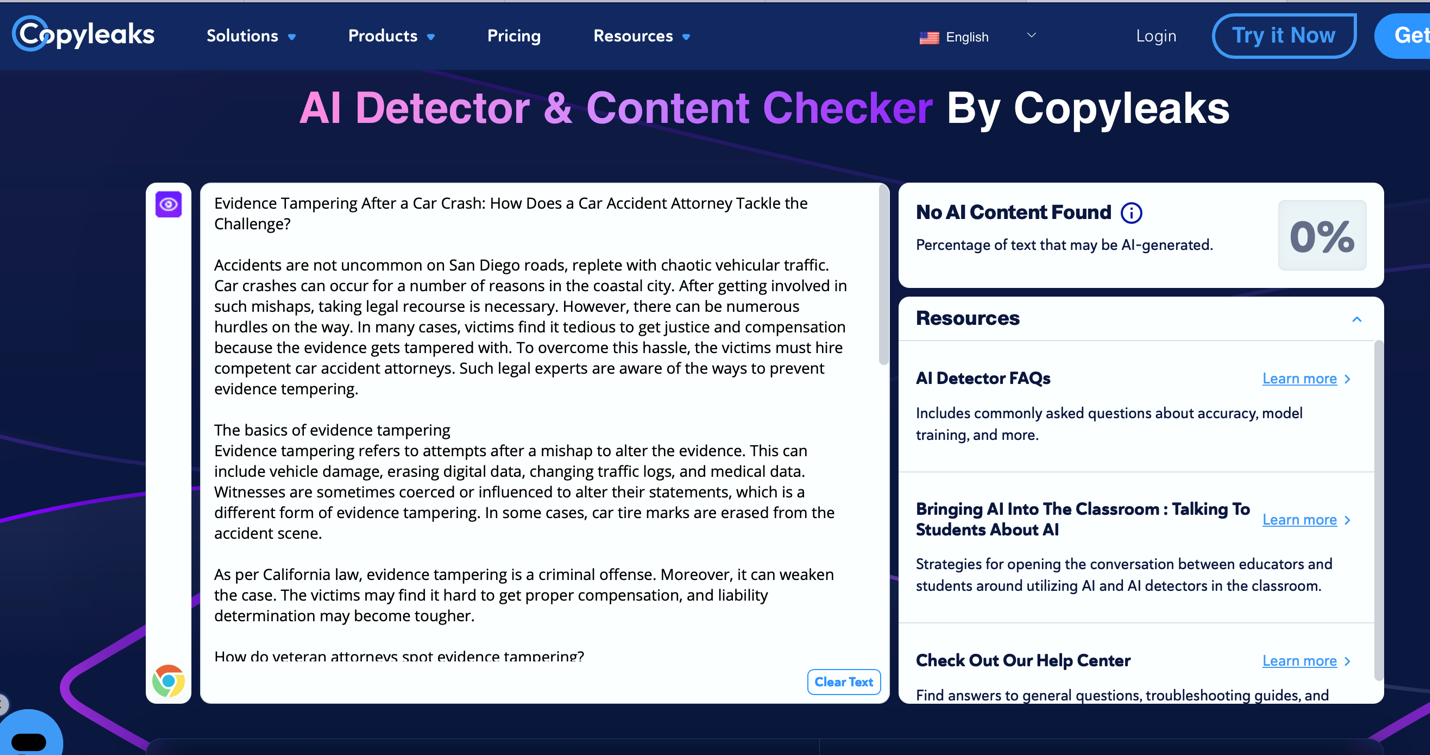

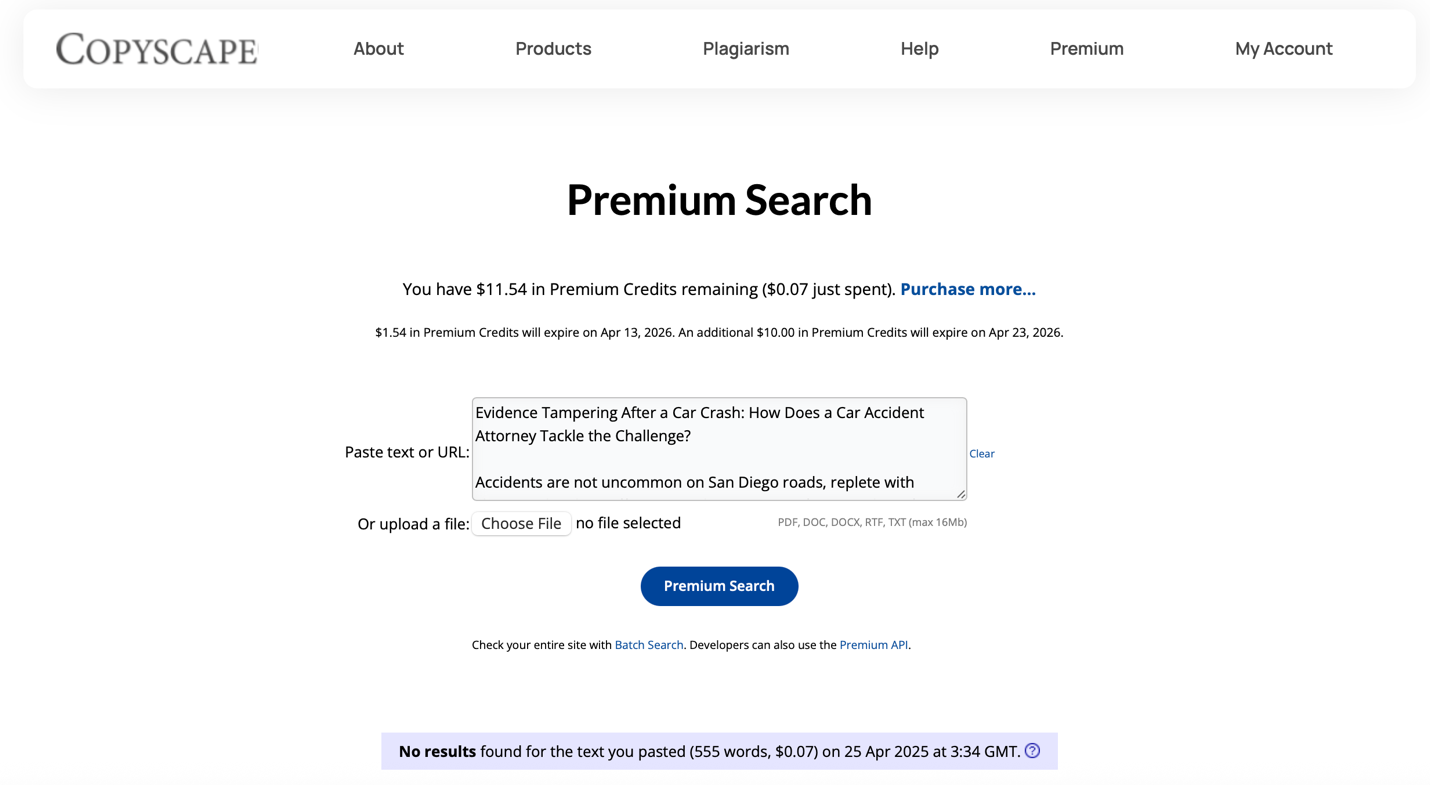

Evidence Tampering After a Car Crash: How Does a Car Accident Attorney Tackle the Challenge?

Accidents are not uncommon on San Diego roads, replete with chaotic vehicular traffic. Car crashes can occur for a number of reasons in the coastal city. After getting involved in such mishaps, taking legal recourse is necessary. However, there can be numerous hurdles on the way. In many cases, victims find it tedious to get justice and compensation because the evidence gets tampered with. To overcome this hassle, the victims must hire competent car accident attorneys. Such legal experts are aware of the ways to prevent evidence tempering.

The basics of evidence tampering

Evidence tampering refers to attempts after a mishap to alter the evidence. This can include vehicle damage, erasing digital data, changing traffic logs, and medical data. Witnesses are sometimes coerced or influenced to alter their statements, which is a different form of evidence tampering. In some cases, car tire marks are erased from the accident scene.

As per California law, evidence tampering is a criminal offense. Moreover, it can weaken the case. The victims may find it hard to get proper compensation, and liability determination may become tougher.

How do veteran attorneys spot evidence tampering?

Veteran car accident attorneys are capable of spotting inconsistencies in such cases. They look for the following issues when investigating such cases:

- Discrepancy in statements collected from the eyewitnesses.

- Conflicting statements from the car drivers.

- Dashcam and CCTV footage that looks questionable.

- Disappearance of accident signs like skid marks from the accident spot.

Not every attorney is capable of analyzing such finer nuances when dealing with such cases. To find trusted and veteran attorneys to handle such cases, one can explore https://hhjtrialattorneys.com/san-diego-car-accident-lawyer/.

Tactics used by ace legal experts to handle evidence tampering

Seasoned car accident attorneys’ resort to various tried and tested strategies to reduce the risk of evidence tampering.

- They try to gather as much evidence as possible from the accident spot and the witnesses. They gather recorded digital evidence and keep a copy. These include CCTV and surveillance clips, images of the cars involved in the mishap, and footage, if available.

- When such legal experts feel some evidenc’e may have been eliminated or tampered with, they resort to advanced digital technologies. For example, the absence of tire marks and video clips may make it hard to decipher which car lost control and rammed into other vehicles. These attorneys team up with crash reconstruction experts and AI technology specialists to develop an accident simulation.

- These attorneys rely on different types of records, such as car GPS data and mobile call logs of the drivers, to develop their cases and overcome inadequate evidenc’e issues.

- To reduce the scope of witnesses changing their versions and forgetting key details related to the crash, such legal experts interrogate them without delay.

Even when direct evidence is scarce, such legal expert may use sold circumstantial evidenc’e like phone record time stamps to prove their points.

Final words

One should contact veteran attorneys soon after the mishap to ensure the evidence does not get erased or tampered with after an accident. The sooner an expert attorney can investigate the case, the better it is for evidence collection and development. Of course, assessing such legal experts is necessary before choosing them.

INSURANCE

How to Deal with the Insurance Company After a Car Accident

No one expects to be in a car accident. But when it happens, the aftermath can feel overwhelming. Dealing with injuries and financial losses can be hard, especially in expensive cities like Philadelphia, where the cost of living is 5% more than the national average. Between dealing with injuries, vehicle repairs, and emotional stress, the last thing you want is to struggle with insurance companies. Yet, that’s exactly what many accident victims in Philadelphia face.

Insurance companies are businesses. Their goal is to minimize payouts while making it seem like they’re helping you. This is where having the right approach matters. Knowing how to communicate with them can make a significant difference. Consulting a car accident lawyer in Philadelphia can ensure you don’t settle for less than you deserve.

Let’s break down the steps you should take when dealing with insurance companies after an accident.

Notify Your Insurance Provider Immediately

The first step is simple: report the accident to your insurer as soon as possible. Most policies require prompt notification. Delaying this could lead to complications with your claim.

When you make this call, stick to the basic facts. Tell them where and when the accident happened but avoid admitting fault or speculating about details. Anything you say can be used to reduce or deny your claim.

Be Cautious When Speaking to the Other Party’s Insurer

If the other driver’s insurance company contacts you, proceed with caution. Their representatives might seem friendly, but their job is to protect their company’s interests.

Here’s what you should keep in mind:

- You are not required to give a recorded statement.

- Avoid discussing injuries until you’ve seen a doctor. Some symptoms take time to appear.

- If you’re uncertain, direct them to your attorney or let them know you’ll respond in writing.

Document Everything Thoroughly

Strong evidence strengthens your claim. Gather and keep the following:

- Photos of the accident scene, vehicle damage, and injuries.

- Medical records detailing your treatment.

- A copy of the police report.

- Witness statements, if available.

Keeping a journal of how the accident affects your daily life can also be useful. Pain, mobility issues, emotional distress—these details could support your claim for fair compensation.

Don’t Rush Into a Settlement

Insurance companies often offer quick settlements. While it may seem tempting, these offers are usually much lower than what you actually need to cover medical bills, lost wages, and other damages.

Before accepting anything, consider:

- Have all injuries been fully treated?

- Are future medical expenses accounted for?

- Will this compensation truly cover all financial losses?

If there’s any doubt, seek legal advice before signing anything. Once you accept a settlement, you can’t ask for more later.

Get Legal Help if Needed

If the claims process becomes frustrating or if the insurance company is unfairly denying your claim, you don’t have to handle it alone. An experienced car accident lawyer can negotiate on your behalf and ensure your rights are protected.

Legal professionals understand the tactics insurance companies use. With their help, you stand a much better chance of receiving the compensation you deserve.

Final Thoughts

Dealing with insurance companies after a car accident isn’t easy, but being informed can make a world of difference. Stick to the facts, document everything, and don’t let them pressure you into settling too soon. If things get complicated, seeking legal guidance is always a smart move.

Your health and financial well-being should always come first. Stay patient, stay cautious, and make sure you get the support you need.

INSURANCE

Factors That Increase the Value of a Car Accident Claim

Car accidents can be a traumatic experience. Dealing with the legal aftermath can be even more stressful. People may be waiting to receive fair compensation to recover their losses. They should know there are some factors that can help increase the value of their car accident claim.

This article discusses everything that increases the total value of car accident compensation. If you are still unsure, you can contact Rawlins Law Accident & Injury Attorneys, who specialize in helping accident victims to ensure they receive maximum compensation.

Severity of Injuries and Medical Treatment

Your compensation depends on the injuries you experience during the accident. The worth of settlements increases dramatically if injuries surpass a specific threshold because of various combined factors.

- Comprehensive Medical Documentation: Medical documentation from healthcare professionals functions as verified evidence that shows your injuries. Detailed medical documentation serves as an essential requirement.

- Treatment Consistency:Medical advice from your doctor needs to be followed continuously to prove that your injuries exist. Insurance adjusters search for periods without medical care as a basis to prove your injuries are less serious than you describe. Your condition becomes clearer through regular doctor visits and proper therapy implementation.

- Long-term Impact: Claims for permanent disabilities together with scarring along with chronic pain typically receive greater compensation amounts. The inability to work alongside the loss of ability to enjoy life or perform daily activities creates higher claim value because these substantial life changes need appropriate financial support.

Liability Evidence and Documentation

The strength of evidence supporting the other driver’s fault directly impacts your claim value.

- Clear Fault Determination:Clear fault leads to increased payouts. The presentation of complete evidence through police reports and witness statements, together with photographs from accident scenes, provides unambiguous proof of responsibility, thus shielding your compensation from insurance company attempts to reduce payouts by attributing joint liability.

- Professional Accident Investigation:Experienced investigators use their expertise to discover important information that investigators without their background might fail to observe. Professional examination of accidents by reconstruction specialists allows you to build stronger evidence that lawyers can use for negotiation purposes.

Insurance Coverage Considerations

Available insurance coverage sets practical limits on potential compensation.

- Policy Limits: Owners of insurance policies define the highest compensation level that their carriers can provide. Serious claims require analyzing all potential insurance benefits as well as using the homeowner’s underinsured motorist coverage amount.

- Bad Faith Practices:Insurance companies must carry out their duties with complete honesty and fairness according to legal requirements. Your overall settlement amount may grow if insurance companies violate their duty to handle claims properly because this behavior could lead to bad faith penalties.

- Legal Representation Quality: Insurance claims succeed more often when victims work with attorneys who possess experience in this field.

- Negotiation Skills:Lawyers who possess insurance claims knowledge stand against insurance companies that try to offer low settlement amounts. Your compensation will be appropriate because your attorney uses their knowledge of similar cases and settlement patterns to stand for fair compensation.

Trial Experience

The presence of attorneys who have demonstrated trial competence gives insurance companies an additional reason to settle claims outside the courtroom. The risk of trial preparation convinces insurance companies to pay better settlements to cases. Your claim results significantly improve with proper legal counsel.

Conclusion

Identifying the main elements affecting claim value will enable you to develop proactive strategies when facing post-accident situations. Proper documentation, consistent medical treatment, and qualified legal representation are your most powerful tools for maximizing compensation.

-

TECHNOLOGY1 year ago

TECHNOLOGY1 year agoElevating Game Day Eats: A Guide to Crafting Crowd-Pleasing Sliders

-

ENTERTAINMENT1 year ago

ENTERTAINMENT1 year agowave_of_happy_: Your Ultimate Guide

-

FASHION1 year ago

FASHION1 year agoGPMsign Fashion: Redefining Style with Purpose

-

TECHNOLOGY12 months ago

TECHNOLOGY12 months agoTrader Joe’s Dayforce: Revolutionizing Workforce Management

-

FOOD1 year ago

FOOD1 year agoAltador Cup Food Court Background: A Culinary Extravaganza Unveiled

-

SPORTS1 year ago

SPORTS1 year agoScore Chaser Sporting Clays: A Thrilling Pursuit of Precision

-

HOME IMPROVEMENT9 months ago

HOME IMPROVEMENT9 months agoWhat Kitchen Renovation Companies Offer Beyond Basic Remodeling

-

NEWS1 year ago

NEWS1 year agoNyl2 Kemono: Unveiling the World