ATM

Cara Membuat ATM Bank DKI

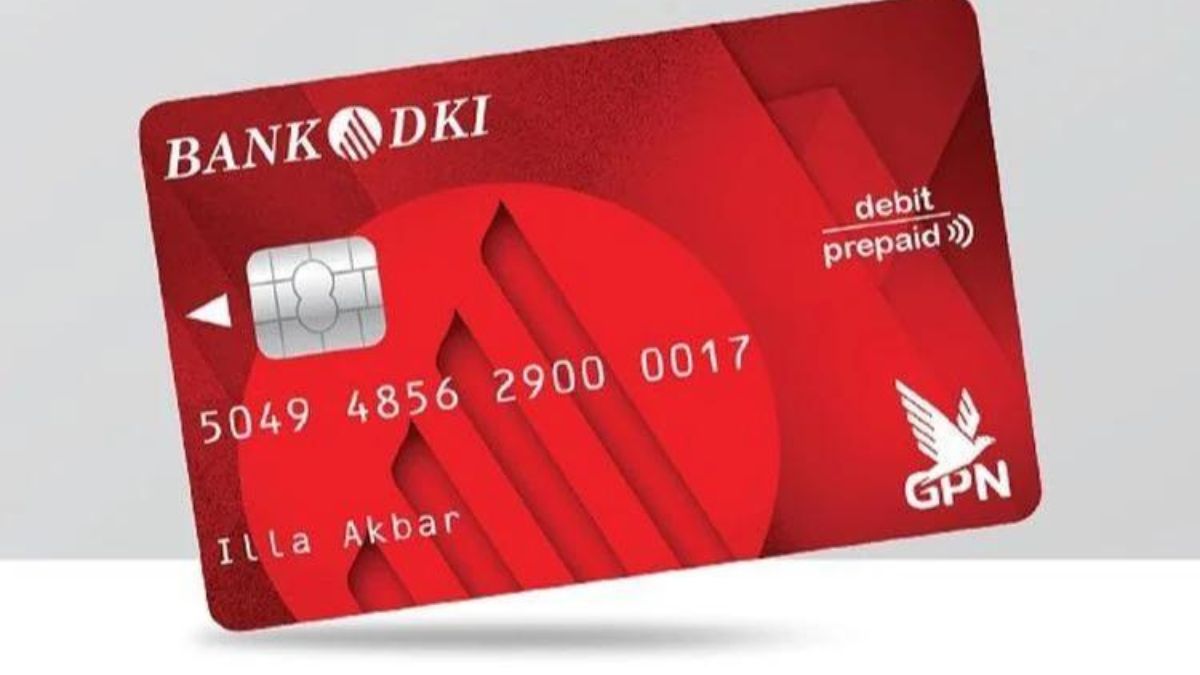

Cara Membuat ATM Bank DKI – Bank DKI adalah salah bank yang ada di bawah kendali Pemerintahan Provinsi DKI Jakarta. Selain di DKI, Bank DKI juga dapat ditemukan di kota-kota besar di pulau Jawa. Bank DKI berdiri pertama kali pada tahun 1961 dengan nama “PT Bank Pembangunan Daerah Djakarta Raya”. Pada ulasan kali ini, akan kami jelaskan khusus bagaimana cara membuat ATM Bank DKI.

Dari banyaknya bank yang termasuk ke dalam Bank Pembangunan Daerah, bank ini juga menerapkan 2 sistem yaitu konvensional dan syariah. Namun Bank DKI Syariah hanya terdapat di kota-kota tertentu seperti Jakarta, Jawa Barat, dan Banten. Pada tahun 1992 Bank DKI resmi menjadi Bank Devisa. Pada tahun 1999, Bank DKI berubah bentuk badan hukum dari Perusahaan Daerah menjadi Perseroan Terbatas.

Bank DKI juga terus meningkatkan performa sarana teknologi informasi dan pengembangan jaringan layanan sehingga nasabah menjadi lebih mudah bertransaksi. Per April 2018, jumlah total kantor layanan sebanyak 267 kantor dengan jumlah ATM Bank DKI sebanyak 946 mesin ATM yang tersebar hingga ketingkat kelurahan. Bank DKI banyak mendapatkan penghargaan yang artinya bahwa Bank DKI selalu memberikan pelayanan yang baik kepada nasabahnya.

Pada masa sekarang ini, kebutuhan akan perbankan semakin tinggi. Transaksi terus meningkat akibat adanya pandemi. Banyak orang yang awalnya belum mempunyai rekening, kini berbondong-bondong pergi ke bank untuk membuka rekening. Banyak pilihan jenis bank yang dapat menjadi pilihan. Salah satunya Bank DKI yang cocok menjadi pilihan Anda terutama bagi Anda yang tinggal di daerah DKI Jakarta. Mari simak terus ulasan di diatm.com.

SYARAT DAN JENIS TABUNGAN BANK DKI

Syarat Umum

- Kartu Identitas yaitu fotocopy KTP/SIM atau Paspor. Bagi yang berumur 17 tahun ke bawah bisa menggunakan kartu pelajar disertai fotocopy KTP orang tua.

- Calon nasabah harus merupakan warga negara Indonesia atau berdomisili di Jakarta/sedang berada di wilayah Jakarta.

- Mengisi formulir pendaftaran.

- Setoran awal minimun tergantung dengan jenis tabungan yang dipilih.

Cara Membuat ATM Bank DKI

- Langkah pertama adalah menyiapkan segala berkas persyaratan. Pastikan semuanya telah Anda siapkan tanpa ada yang tertinggal.

- Kedua, kunjungi kantor cabang Bank DKI terdekat.

- Ketika Anda sudah tiba di bank, maka satpam yang bertugas akan menyambut Anda. Biasanya petugas satpam yang akan mengambil nomor antri dan memberikannya kepada Anda serta akan menanyakan tujuan Anda apa. Petugas juga akan mengarahkan anda harus kemana.

- Selanjutnya, setelah tiba nomor antrian Anda silahkan langsung menuju Customer Service. Kemudian mengisi formulir pendaftaran dan jangan sungkan untuk bertanya kepada petugas jika ada informasi yang belum Anda tahu.

- Dengarkan penjelasan petugas tentang jenis pilihan tabungan. Kemudian petugas akan membantu Anda menentukan jenis tabungan apa yang sesuai dengan kebutuhan Anda.

- Langkah selanjutnya adalah membayarkan uang setoran awal. Besarnya sesuai jenis tabungan yang telah Anda pilih.

- Setelah itu customer service akan memberikan buku tabungan berserta kartu ATM atas nama Anda.

- Kemudian Anda akan membuat PIN ATM dengan menuju teller yang sedang bertugas.

- Buku Tabungan dan Kartu ATM yang Anda dapatkan kini sudah bisa Anda pakai.

Jenis Tabungan Bank DKI

1. Tabungan Simpeda

Tabungan jenis ini termasuk bagian dari Bank Pembangunan Daerah (BPD). Maka Anda dapat melakukan transaksi pada seluruh jaringan BPD se-Indonesia. Setoran awal minimum tabungan Simpeda sebesar Rp 50.000. Sedangkan biaya administrasinya adalah sebesar Rp 7.500/Bulan.

2. Tabungan Monas Umum

Tabungan Monas pada Bank DKI mempunyai banyak jenis bukan hanya yang Umum saja yaitu terdiri dari : Monas Bisnis, Monas Bisnis Perkulakan, Monas Pelajar, dan Monas Mahasiswa. Untuk informasi lebih lanjutnya silahkan mengakses link https://www.bankdki.co.id/id/. Untuk jenis Monas Umum mempunyai biaya setoran awal minimun sebesar Rp 20.000 dan biaya admin sebesar Rp 10.000/bulan.

3. TabunganKu

Jenis tabungan ini dapat dimiliki oleh nasabah yang berusia di bawah 17 tahun. Maka sangat cocok untuk pelajar karena jenis tabungan ini biaya administrasi bulanan. Besar biaya setoran awal yaitu Rp 20.000. TabunganKu hanya dapat melakukan penarikan tunai dan pemindahan buku tabungan di kantor cabang tempat melakukan pembukaan rekening.

Kesimpulan

Dapat kami simpulkan bahwa cara untuk membuat ATM Bank DKI tidaklah membutuhkan perlakuan yang rumit. Anda cukup mengikuti langkah-langkah yang telah kami sebutkan di atas. Dan juga dapat kami rangkum bahwa ada 3 jenis tabungan di Bank DKI yang dapat menjadi pilihan Anda untuk membuka rekening di Bank DKI. Untuk info lebih lanjut Anda dapat mengunjungi website resmi Bank DKI yaitu : https://www.bankdki.co.id/id/. Perhatikan juga FAQ dibawah ini.

Maksimal Rp 10.000.000

PBB secara online, dan Samsat

Ya, hanya pada jenis tabungan Monas Bisnis

Rp 50.000

Tidak

Demikian tadi seputar informasi terkait bagaimana cara membuat ATM Bank DKI. Semoga informasi ini bermanfaat bagi Anda yang membutuhkannya. Jika ada pertanyaan terkait pembukaan rekening Bank DKI silahkan mengubungi Call Center resmi di nomor 1500-351. Silahkan baca juga artikel kami yang lainnya seperti tentang Cara Membuat ATM BNI.

ATM

Cara Melacak Kartu ATM yang Hilang: Navigating the Maze of Lost Cards

While losing your ATM card might be rather upsetting, there are efficient methods for finding it and getting it back. This tutorial will walk you through the exact steps of finding a misplaced ATM card and provide advice on how to avoid it in the future.

Immediate Steps to Take

Taking immediate action is essential as soon as you realise your ATM card is gone. Notify your bank of the loss first. To let them know about the circumstance, get in touch with customer service or stop by the closest branch. Block your card at the same time to stop any unauthorised transactions. Finally, report the missing card to the local authorities by providing details.

Utilizing Banking Apps

The procedure of tracking missing cards has been made easier by contemporary banking apps. Enter your login credentials and go to the card services section of your mobile banking app. Frequently, options to report a missing card and check its status can be found here. For a speedy resolution, adhere to the given instructions.

Contacting Customer Service

Contact the customer care department of your bank if you’re unsure. For assistance in cases of lost or stolen cards, they have specialised teams. To speed up the process, provide them with all the information they need, including your account information and the specifics of the card loss.

GPS Tracking Technology

Certain banks use GPS tracking technology to find missing credit cards. This approach, while not infallible, can work well when used in conjunction with law enforcement. Inquire about possible cooperation with local authorities and find out if your bank has GPS tracking capabilities.

Preventive Measures

The key is prevention. Use these easy steps to save yourself the trouble of tracking down a lost card: store your card safely, don’t share PINs, and use caution while making purchases. Protecting private data is essential to preventing unwanted access.

Common Mistakes to Avoid

Typical errors that occur when tracking down a misplaced card can complicate matters. Make sure the information you give the bank is accurate, and check it again before reporting a loss. Errors may cause the healing process to drag on.

Legal Aspects of Lost Cards

It’s crucial to comprehend the legal ramifications of misplaced cards. Different banks have different rules about who is responsible for illegal transactions. Learn the terms and conditions of your bank and be aware of your rights if there are any problems.

Online Communities and Forums

Utilise the pooled expertise of online forums and communities. Many people talk about their experiences and offer insightful advice on how to find misplaced cards. Interacting with these platforms might provide further direction and assistance.

Alternative Payment Methods

While you wait for a replacement card, look into other ways to pay. You may still easily manage your finances in the interim by using digital wallets and other online payment methods.

Staying Informed

Keep up with the updates from your bank. Keep a close eye out for any unauthorised transactions on your financial statements. Extra security is added when you monitor your accounts proactively.

Privacy Concerns

Consider privacy issues as you work through the lost card tracing procedure. It is advisable to prioritise the security of your data and refrain from transmitting critical information through unsafe channels.

Educational Campaigns

Banks are essential in teaching consumers how to use their cards responsibly. Keep an eye out for your bank’s educational initiatives and materials if you want to learn more about card security.

Future Trends in Card Security

Technological developments are still influencing card security. Future developments include improved encryption, biometric authentication, and other advancements. Make sure you implement the most recent security measures by keeping up with current trends.

Conclusion

To sum up, tracking a missing ATM card requires a combination of technological support, quick action, and precautionary steps. You can confidently navigate the lost card maze by adhering to the indicated measures and keeping up with the latest security trends.

FAQs

What should I do first if my ATM card is lost?

Immediately report the loss to your bank, block the card, and notify local authorities.

Can I track my lost card through a banking app?

Yes, most modern banking apps have features to report a lost card and track its status.

What legal recourse do I have for unauthorized transactions?

Familiarize yourself with your bank’s policies on liability for unauthorized transactions and know your rights.

Are there alternative payment methods while waiting for a new card?

Yes, explore digital wallets and other online payment options as temporary solutions.

How can I stay informed about my account security?

Regularly check your financial statements and stay alert to notifications from your bank.

ATM

Uang Bayar Saku Kartu ATM: Unlocking Financial Freedom

Understanding phrases like “uang bayar saku kartu atm” becomes essential when it comes to personal finance. Our daily lives are significantly impacted by the complexities of financial tools and their uses. This essay explores the idea of “uang bayar saku” and how it relates to kartu ATM’s convenience.

Understanding “Uang Bayar Saku”

“Uang bayar saku” means pocket money, which is a sum of money set aside for regular expenses. This phrase, which denotes financial responsibility and autonomy, has cultural importance. It’s the stipend that gives people the independence to take care of their urgent requirements.

The Role of Kartu ATM in Daily Transactions

Automated Teller Machine (ATM) cards from Kartu have become a crucial component of our financial environment. We can easily carry out a variety of transactions with these plastic marvels, including cash withdrawals and purchases. The cooperation of kartu ATM and “uang bayar saku” improves the effectiveness of routine financial operations.

Common Issues with Kartu ATM Transactions

Users may experience difficulties with their kartu ATM transactions despite the ease. It’s critical to be aware of potential problems, from transaction failures to security vulnerabilities. This post offers perceptions into typical issues and workable fixes to guarantee a positive encounter.

Safety Measures for Kartu ATM Usage

While we appreciate the ease of Kartu ATMs, it is crucial to protect personal data. In order to enable consumers to securely navigate the world of electronic transactions, this section discusses critical safety precautions.

Benefits of Having “Uang Bayar Saku” in Kartu ATM

There are many advantages when “uang bayar saku” and kartu ATM are combined. This financial tool is a great asset to have as it’s easy to use for tracking and controlling daily spending, in addition to providing financial activity monitoring and control.

How to Apply for Kartu ATM with “Uang Bayar Saku”

Would you like to purchase a kartu ATM with “uang bayar saku” for yourself? This section describes the documentation required for a successful application and offers a step-by-step guide through the application process.

Comparison with Other Payment Methods

Even though kartu ATMs are convenient, it’s important to consider their advantages and disadvantages in comparison to alternative payment options like credit cards and mobile wallets. Considering their financial needs, readers can make well-informed judgements with the help of this section.

Popular Banks Offering “Uang Bayar Saku” on Kartu ATM

Examine the array of financial institutions offering this feature on their kartu ATMs. It might be helpful for customers to select the best financial institution for their needs to be aware of the distinctive benefits that each bank may offer.

Tips for Managing “Uang Bayar Saku” Wisely

Effective pocket money management is a skill. This section offers helpful advice and budgeting techniques to enable people to maximise their “uang bayar saku” while avoiding unneeded spending.

The Future of “Uang Bayar Saku” on Kartu ATM

The environment of financial tools is always changing in tandem with technology. Examine the new developments and trends that could influence “uang bayar saku” on kartu ATM in the future and offer an insight into the next chapter in the history of personal finance.

Real-Life Experiences and Testimonials

Find out how people use the “uang bayar saku” feature on their kartu ATM on a regular basis. Testimonials and real-life experiences demonstrate how this financial feature improves people’s financial decision-making and autonomy.

Conclusion

To sum up, “uang bayar sak’u kartu atm” is a lifestyle term as much as a financial one. Accepting the partnership between Pocket Money and kartu ATM improves financial responsibility and independence. A step towards a more empowered financial future is to investigate the opportunities provided by this dynamic combination as we traverse the always-changing world of personal finance.

FAQs

Can I use “uang bayar sak’u” for online transactions with my kartu ATM?

Yes, many kartu ATM cards are equipped for online transactions, allowing you to use your “uang bayar sak’u” digitally.

Are there any age restrictions for applying for a kartu ATM with “using bayar sak’u?”

Age requirements may vary between banks, but most institutions offer kartu ATM with pocket money features for individuals of various age groups.

How can I check the balance of my “uang bayar sak’u” on my kartu ATM?

You can check the balance through ATMs, online banking, or mobile apps provided by your bank.

What should I do if I lose my kartu ATM with “uang bayar sak’u” feature?

Immediately contact your bank’s customer service to report the loss and block the card. Most banks have a 24/7 helpline for such emergencies.

Can I withdraw cash from any ATM using my kartu ATM with “uang bayar sak’u”?

In most cases, you can withdraw cash from any ATM, but be aware of potential fees, especially if the ATM is not affiliated with your bank.

ATM

ATM Toto: Revolutionizing Secure Transactions

Imagine living in a future where using ATMs is not only a transactional process but also safe, practical, and cutting-edge in terms of technology. Presenting ATM Toto, a state-of-the-art advancement in the field of automated teller machines. This essay will examine the complexities of ATM Toto, including its features, benefits, drawbacks, and possible effects on the world financial system.

What is ATM Toto?

An innovative take on a classic ATM, ATM Toto is notable for its distinct approach to safeguarding transactions. By using cutting-edge technologies and improved security measures, ATM Tot’o redefines the user experience in contrast to traditional ATMs.

How Does ATM Toto Work?

Knowing how ATMs work To understand Toto’s importance, you must first grasp it. The procedure ensures a safe and effective transaction by allowing the user and the machine to interact seamlessly. Every stage, from real-time transaction monitoring to biometric verification, is painstakingly crafted with user safety as its top priority.

Advantages of ATM Toto

The unmatched user convenience of ATM Tot’o is one of its main benefits. Personalised preferences and cardless transactions are only two elements that make banking easier for users. Furthermore, the strong security protocols that ATM Tot’o has put in place give users and their financial assets even more security.

Dissecting ATM Toto Technology

ATM Tot’o’s technology is an intriguing fusion of creativity and usefulness. By utilising the most recent developments in biometrics, artificial intelligence, and data analytics, ATM Tot’o remains ahead of the curve as the financial sector embraces digital transformation.

ATM Toto vs. Traditional ATMs

When comparing ATM Tot’o to conventional ATMs, it becomes evident how much more user-friendly and efficient it is. ATM Tot’o is a strong contender in the financial technology market thanks to its user-friendly interface and quick transaction processing.

Challenges and Concerns

ATM Tot’o has several advantages, but it’s important to deal with any potential issues or worries. Technical difficulties and cybersecurity risks are only two examples of the problems that could occur, but they can be lessened with proactive steps and regular updates.

Global Impact of ATM Toto

ATM Tot’o adoption is not limited to a certain area; it is becoming more and more prevalent worldwide. Global financial institutions are realising ATM Tot’o’s disruptive potential, which is causing a paradigm shift in how consumers use banking services.

Security Measures in ATM Toto

ATM Tot’o was designed with transaction security as the priority. Every element, including biometric authentication and end-to-end encryption, has been thoughtfully designed to protect user information and financial assets. Fraud prevention techniques further strengthen the overall security framework.

Future Prospects of ATM Toto

There are a lot of intriguing possibilities for ATM Tot’o’s future. Forecasts indicate that technology will continue to progress, expanding ATM Tot’o’s possibilities. The future of safe transactions will be shaped by ATM Tot’o’s role as the financial ecosystem changes.

User Testimonials

Actual encounters with ATMs Toto gives a clear illustration of its advantages. Customers praise this cutting-edge technology’s efficiency, security, and ease of use, emphasising how it has made their financial transactions simpler.

ATM Toto Regulations

ATM Tot’o conforms to industry standards and is subject to government inspection in a world where financial regulations are in place. Tight rules guarantee that ATM Toto’s deployment is consistent with the larger financial scene, fostering dependability and confidence.

Integration of ATM Toto in Financial Institutions

An important step towards modernity has been taken with the integration of ATM Tot’o into financial institutions. The smooth integration of ATM Tot’o into current banking services is being facilitated by partnerships and collaborations between banks and technology companies.

Conclusion

Finally, ATM Toto proves to be a disruptive force in safe transactions. Its unique combination of cutting-edge technology, heightened security protocols, and intuitive user interface positions it as a disruptive force in the financial sector. ATM Tot’o is leading the way in the digital age, influencing the ease and security of banking in the future.

FAQs

Is ATM Tot’o available globally?

Yes, ATM Tot’o is gradually expanding its presence globally, with financial institutions adopting this technology.

How secure are transactions with ATM Tot’o?

ATM Tot’o prioritizes security, implementing robust measures such as biometric authentication and encryption to ensure secure transactions.

Can ATM Tot’o be integrated into existing bank services?

ATM Tot’o is designed for seamless integration into existing financial institutions, fostering modernization and efficiency.

What sets ATM Tot’o apart from traditional ATMs?

ATM Tot’o distinguishes itself through advanced technology, enhanced security, and a user-friendly interface, offering a superior banking experience.

Are there any regulatory concerns with ATM Tot’o?

ATM Tot’o adheres to strict financial regulations, ensuring compliance and trustworthiness in its implementation.

-

TECHNOLOGY2 years ago

TECHNOLOGY2 years agoElevating Game Day Eats: A Guide to Crafting Crowd-Pleasing Sliders

-

ENTERTAINMENT2 years ago

ENTERTAINMENT2 years agowave_of_happy_: Your Ultimate Guide

-

FASHION2 years ago

FASHION2 years agoGPMsign Fashion: Redefining Style with Purpose

-

TECHNOLOGY2 years ago

TECHNOLOGY2 years agoTrader Joe’s Dayforce: Revolutionizing Workforce Management

-

FOOD2 years ago

FOOD2 years agoAltador Cup Food Court Background: A Culinary Extravaganza Unveiled

-

HOME IMPROVEMENT1 year ago

HOME IMPROVEMENT1 year agoWhat Kitchen Renovation Companies Offer Beyond Basic Remodeling

-

SPORTS2 years ago

SPORTS2 years agoScore Chaser Sporting Clays: A Thrilling Pursuit of Precision

-

NEWS2 years ago

NEWS2 years agoNyl2 Kemono: Unveiling the World