INSURANCE

jason bunch insurance dayton: A deep dive

When it comes to securing your future, choosing the right insurance provider is crucial. In Dayton, one name stands out: Jason Bunch Insurance. With a commitment to personalized service and a deep understanding of their client’s needs, this agency has become a trusted ally for individuals and families alike. Whether you’re seeking auto, home, or life insurance coverage, Jason Bunch Insurance offers tailored solutions designed just for you. Let’s delve deeper into what makes this company a preferred choice in the vibrant city of Dayton.

History and background of the company

Jason Bunch Insurance was established with a vision to provide personalized insurance solutions for the Dayton community. Founded by Jason Bunch himself, the company emerged from a desire to offer more than just policies; it aimed to create meaningful relationships with clients.

Over the years, Jason has cultivated a reputation rooted in trust and reliability. His commitment extends beyond transactions, focusing on understanding each client’s unique needs.

The agency started small but steadily grew as word spread about its exceptional service. This growth reflects not only the quality of offerings but also an unwavering dedication to customer satisfaction.

As residents began recognizing their expertise, Jason Bunch Insurance became synonymous with integrity in Dayton’s insurance landscape. Today, it stands proud as a cornerstone of support for individuals and businesses navigating their coverage options.

Services offered by Jason Bunch Insurance

Jason Bunch Insurance offers a diverse range of services tailored to meet the needs of its clients. Whether you’re looking for personal coverage or business solutions, they have you covered.

Auto insurance is one of their standout offerings. Clients can choose from various plans that provide essential protection on the road.

Homeowners insurance is another key service, safeguarding your property against unexpected events. This includes everything from fire damage to theft.

For those running small businesses, Jason Bunch Insurance provides specialized commercial policies. These are designed to protect assets and mitigate risks unique to each industry.

Life insurance options are also available, providing peace of mind for families planning for the future. Each policy can be customized based on individual circumstances and goals.

Their commitment doesn’t stop at just selling policies; they emphasize ongoing support and guidance throughout your insurance journey.

Customer reviews and satisfaction ratings

Customer feedback plays a vital role in understanding any business. Jason Bunch Insurance has garnered positive reviews from clients across Dayton.

Many customers highlight the personalized service they receive. They appreciate how attentive and approachable the team is. Quick responses to queries are often mentioned, giving peace of mind during stressful situations.

Satisfaction ratings reveal that policyholders feel valued and understood. The company’s commitment to building lasting relationships shines through these testimonials.

Furthermore, clients frequently commend the transparency during the insurance process. No hidden fees or surprises—just honest communication about coverage options.

This level of trust fosters loyalty among their customer base, making them a preferred choice for many in Dayton seeking reliable insurance options.

How Jason Bunch Insurance stands out from other insurance companies in Dayton

Jason Bunch Insurance distinguishes itself through its personalized approach. Unlike larger corporations, this agency prioritizes building genuine relationships with clients. Each customer receives tailored solutions that reflect their unique needs.

The team at Jason Bunch Insurance is known for its accessibility and responsiveness. Clients can expect prompt replies to inquiries and a friendly atmosphere where questions are welcomed.

Moreover, the company emphasizes community involvement. They regularly support local events and charities, reinforcing a strong connection with Dayton residents. This commitment not only enhances their reputation but fosters trust among customers.

Another standout feature is their comprehensive coverage options. From auto to home insurance, Jason Bunch Insurance offers diverse plans designed to cater to varying lifestyles and budgets, ensuring everyone finds the right fit without compromise.

Tips for choosing the right insurance provider

Choosing the right insurance provider can feel overwhelming.

Start by assessing your needs. Consider what types of coverage you require—auto, home, or health. Make a list to clarify your priorities.

Next, research potential companies thoroughly. Look for providers with solid reputations and financial stability. Online reviews can offer valuable insights into customer experiences.

Don’t hesitate to compare quotes from different insurers. This helps you gauge pricing but remember that the cheapest option isn’t always the best quality.

Ask about available discounts and bundling options. Many companies provide savings when you combine multiple policies.

Consider customer service availability. A responsive agency makes navigating claims much easier during stressful times. Trust your instincts; a personal connection often leads to better service in the long run.

Conclusion and Final Thoughts on Jason Bunch Insurance

When considering your insurance options in Dayton, Jason Bunch Insurance stands out for several reasons. With a strong foundation built on years of experience, the company has cultivated a reputation for reliability and personalized service. Their diverse range of offerings ensures that clients can find exactly what they need, whether it’s auto, home, or life insurance.

Customer satisfaction is evident through glowing reviews that highlight their attentive approach and commitment to meeting individual needs. This focus on building relationships sets them apart from larger competitors who may prioritize numbers over people.

Choosing the right insurance provider can be daunting. However, with resources like Jason Bunch Insurance at your disposal, you have access to knowledgeable agents ready to guide you through every step. It’s about more than just policies; it’s about peace of mind and security for you and your family.

As you navigate the world of insurance providers in Dayton, keep Jason Bunch Insurance at the forefront of your considerations. They embody what it means to serve a community while ensuring each client feels valued and understood. With them by your side, you’re not just another policyholder—you’re part of a family dedicated

Jason bunch insurance Dayton: A deep dive

Introduction to Jason Bunch Insurance

When it comes to securing your future, choosing the right insurance provider is crucial. In Dayton, one name stands out: Jason Bunch Insurance. With a commitment to personalized service and a deep understanding of their client’s needs, this agency has become a trusted ally for individuals and families alike. Whether you’re seeking auto, home, or life insurance coverage, Jason Bunch Insurance offers tailored solutions designed just for you. Let’s delve deeper into what makes this company a preferred choice in the vibrant city of Dayton.

History and background of the company

Jason Bunch Insurance was established with a vision to provide personalized insurance solutions for the Dayton community. Founded by Jason Bunch himself, the company emerged from a desire to offer more than just policies; it aimed to create meaningful relationships with clients.

Over the years, Jason has cultivated a reputation rooted in trust and reliability. His commitment extends beyond transactions, focusing on understanding each client’s unique needs.

The agency started small but steadily grew as word spread about its exceptional service. This growth reflects not only the quality of offerings but also an unwavering dedication to customer satisfaction.

As residents began recognizing their expertise, Jason Bunch Insurance became synonymous with integrity in Dayton’s insurance landscape. Today, it stands proud as a cornerstone of support for individuals and businesses navigating their coverage options.

Services offered by Jason Bunch Insurance

Jason Bunch Insurance offers a diverse range of services tailored to meet the needs of its clients. Whether you’re looking for personal coverage or business solutions, they have you covered.

Auto insurance is one of their standout offerings. Clients can choose from various plans that provide essential protection on the road.

Homeowners insurance is another key service, safeguarding your property against unexpected events. This includes everything from fire damage to theft.

For those running small businesses, Jason Bunch Insurance provides specialized commercial policies. These are designed to protect assets and mitigate risks unique to each industry.

Life insurance options are also available, providing peace of mind for families planning for the future. Each policy can be customized based on individual circumstances and goals.

Their commitment doesn’t stop at just selling policies; they emphasize ongoing support and guidance throughout your insurance journey.

Customer reviews and satisfaction ratings

Customer feedback plays a vital role in understanding any business. Jason Bunch Insurance has garnered positive reviews from clients across Dayton.

Many customers highlight the personalized service they receive. They appreciate how attentive and approachable the team is. Quick responses to queries are often mentioned, giving peace of mind during stressful situations.

Satisfaction ratings reveal that policyholders feel valued and understood. The company’s commitment to building lasting relationships shines through these testimonials.

Furthermore, clients frequently commend the transparency during the insurance process. No hidden fees or surprises—just honest communication about coverage options.

This level of trust fosters loyalty among their customer base, making them a preferred choice for many in Dayton seeking reliable insurance options.

How Jason Bunch Insurance stands out from other insurance companies in Dayton

Jason Bunch Insurance distinguishes itself through its personalized approach. Unlike larger corporations, this agency prioritizes building genuine relationships with clients. Each customer receives tailored solutions that reflect their unique needs.

The team at Jason Bunch Insurance is known for its accessibility and responsiveness. Clients can expect prompt replies to inquiries and a friendly atmosphere where questions are welcomed.

Moreover, the company emphasizes community involvement. They regularly support local events and charities, reinforcing a strong connection with Dayton residents. This commitment not only enhances their reputation but fosters trust among customers.

Another standout feature is their comprehensive coverage options. From auto to home insurance, Jason Bunch Insurance offers diverse plans designed to cater to varying lifestyles and budgets, ensuring everyone finds the right fit without compromise.

Tips for choosing the right insurance provider

Choosing the right insurance provider can feel overwhelming.

Start by assessing your needs. Consider what types of coverage you require—auto, home, or health. Make a list to clarify your priorities.

Next, research potential companies thoroughly. Look for providers with solid reputations and financial stability. Online reviews can offer valuable insights into customer experiences.

Don’t hesitate to compare quotes from different insurers. This helps you gauge pricing but remember that the cheapest option isn’t always the best quality.

Ask about available discounts and bundling options. Many companies provide savings when you combine multiple policies.

Consider customer service availability. A responsive agency makes navigating claims much easier during stressful times. Trust your instincts; a personal connection often leads to better service in the long run.

Conclusion and Final Thoughts on Jason Bunch Insurance

When considering your insurance options in Dayton, Jason Bunch Insurance stands out for several reasons. With a strong foundation built on years of experience, the company has cultivated a reputation for reliability and personalized service. Their diverse range of offerings ensures that clients can find exactly what they need, whether it’s auto, home, or life insurance.

Customer satisfaction is evident through glowing reviews that highlight their attentive approach and commitment to meeting individual needs. This focus on building relationships sets them apart from larger competitors who may prioritize numbers over people.

Choosing the right insurance provider can be daunting. However, with resources like Jason Bunch Insurance at your disposal, you have access to knowledgeable agents ready to guide you through every step. It’s about more than just policies; it’s about peace of mind and security for you and your family.

As you navigate the world of insurance providers in Dayton, keep Jason Bunch Insurance at the forefront of your considerations. They embody what it means to serve a community while ensuring each client feels valued and understood. With them by your side, you’re not just another policyholder—you’re part of a family dedicated to protecting what matters most.

INSURANCE

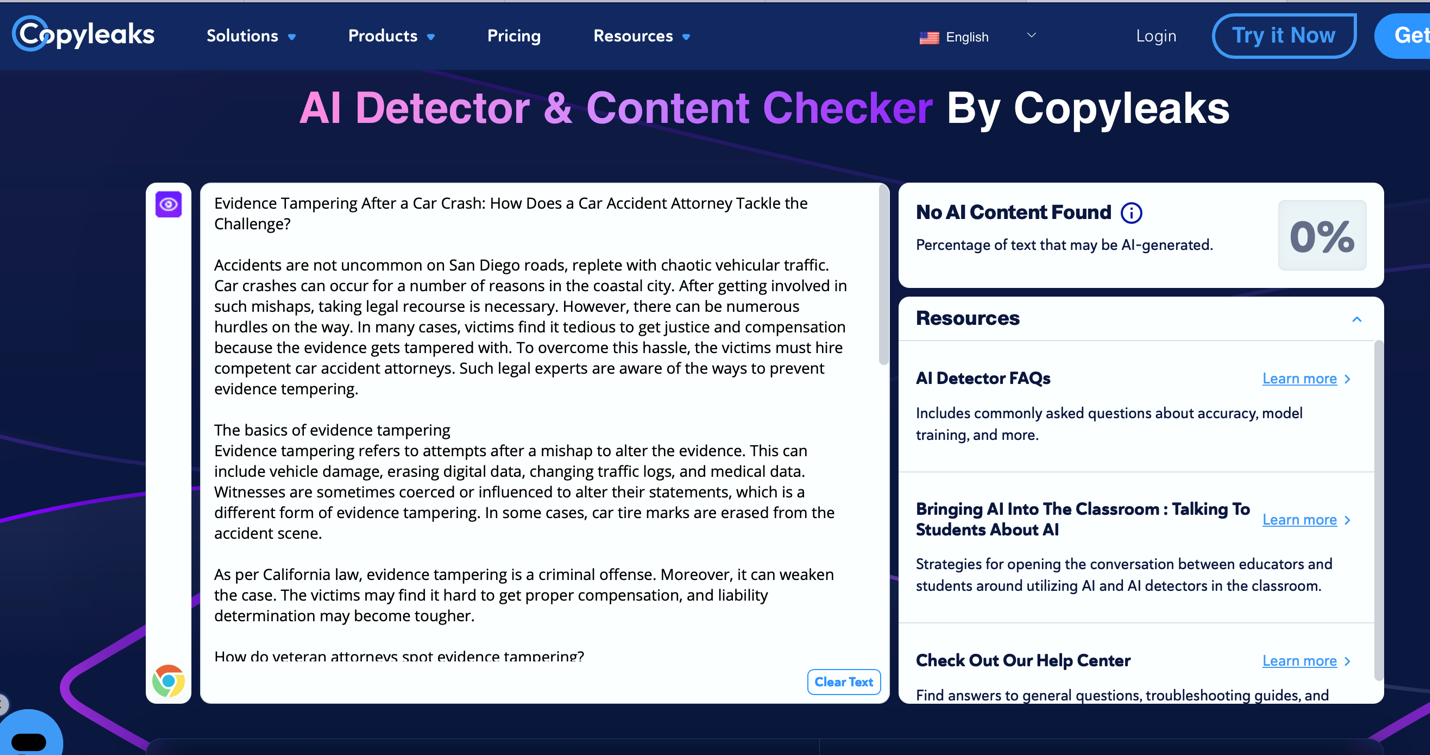

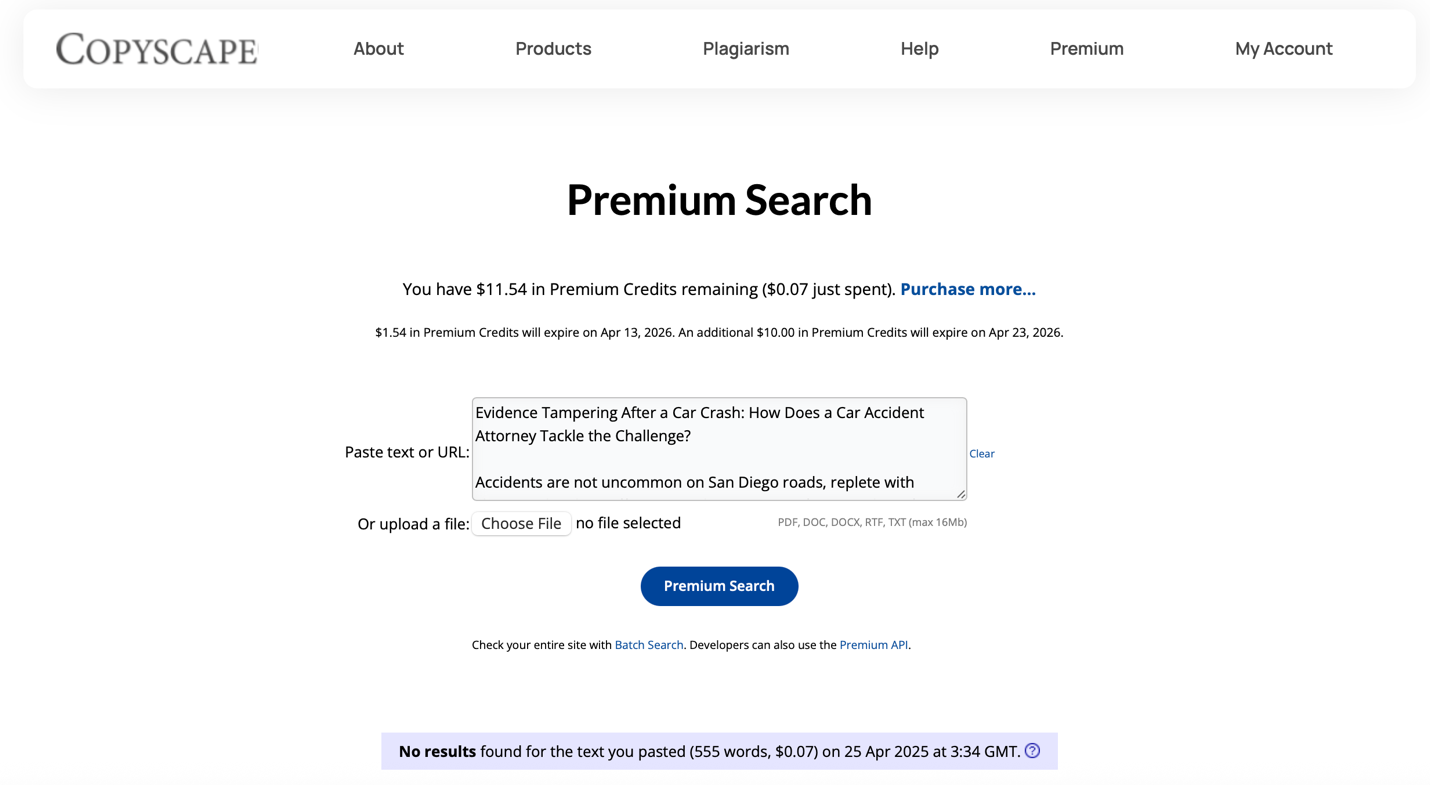

Evidence Tampering After a Car Crash: How Does a Car Accident Attorney Tackle the Challenge?

Accidents are not uncommon on San Diego roads, replete with chaotic vehicular traffic. Car crashes can occur for a number of reasons in the coastal city. After getting involved in such mishaps, taking legal recourse is necessary. However, there can be numerous hurdles on the way. In many cases, victims find it tedious to get justice and compensation because the evidence gets tampered with. To overcome this hassle, the victims must hire competent car accident attorneys. Such legal experts are aware of the ways to prevent evidence tempering.

The basics of evidence tampering

Evidence tampering refers to attempts after a mishap to alter the evidence. This can include vehicle damage, erasing digital data, changing traffic logs, and medical data. Witnesses are sometimes coerced or influenced to alter their statements, which is a different form of evidence tampering. In some cases, car tire marks are erased from the accident scene.

As per California law, evidence tampering is a criminal offense. Moreover, it can weaken the case. The victims may find it hard to get proper compensation, and liability determination may become tougher.

How do veteran attorneys spot evidence tampering?

Veteran car accident attorneys are capable of spotting inconsistencies in such cases. They look for the following issues when investigating such cases:

- Discrepancy in statements collected from the eyewitnesses.

- Conflicting statements from the car drivers.

- Dashcam and CCTV footage that looks questionable.

- Disappearance of accident signs like skid marks from the accident spot.

Not every attorney is capable of analyzing such finer nuances when dealing with such cases. To find trusted and veteran attorneys to handle such cases, one can explore https://hhjtrialattorneys.com/san-diego-car-accident-lawyer/.

Tactics used by ace legal experts to handle evidence tampering

Seasoned car accident attorneys’ resort to various tried and tested strategies to reduce the risk of evidence tampering.

- They try to gather as much evidence as possible from the accident spot and the witnesses. They gather recorded digital evidence and keep a copy. These include CCTV and surveillance clips, images of the cars involved in the mishap, and footage, if available.

- When such legal experts feel some evidenc’e may have been eliminated or tampered with, they resort to advanced digital technologies. For example, the absence of tire marks and video clips may make it hard to decipher which car lost control and rammed into other vehicles. These attorneys team up with crash reconstruction experts and AI technology specialists to develop an accident simulation.

- These attorneys rely on different types of records, such as car GPS data and mobile call logs of the drivers, to develop their cases and overcome inadequate evidenc’e issues.

- To reduce the scope of witnesses changing their versions and forgetting key details related to the crash, such legal experts interrogate them without delay.

Even when direct evidence is scarce, such legal expert may use sold circumstantial evidenc’e like phone record time stamps to prove their points.

Final words

One should contact veteran attorneys soon after the mishap to ensure the evidence does not get erased or tampered with after an accident. The sooner an expert attorney can investigate the case, the better it is for evidence collection and development. Of course, assessing such legal experts is necessary before choosing them.

INSURANCE

How to Deal with the Insurance Company After a Car Accident

No one expects to be in a car accident. But when it happens, the aftermath can feel overwhelming. Dealing with injuries and financial losses can be hard, especially in expensive cities like Philadelphia, where the cost of living is 5% more than the national average. Between dealing with injuries, vehicle repairs, and emotional stress, the last thing you want is to struggle with insurance companies. Yet, that’s exactly what many accident victims in Philadelphia face.

Insurance companies are businesses. Their goal is to minimize payouts while making it seem like they’re helping you. This is where having the right approach matters. Knowing how to communicate with them can make a significant difference. Consulting a car accident lawyer in Philadelphia can ensure you don’t settle for less than you deserve.

Let’s break down the steps you should take when dealing with insurance companies after an accident.

Notify Your Insurance Provider Immediately

The first step is simple: report the accident to your insurer as soon as possible. Most policies require prompt notification. Delaying this could lead to complications with your claim.

When you make this call, stick to the basic facts. Tell them where and when the accident happened but avoid admitting fault or speculating about details. Anything you say can be used to reduce or deny your claim.

Be Cautious When Speaking to the Other Party’s Insurer

If the other driver’s insurance company contacts you, proceed with caution. Their representatives might seem friendly, but their job is to protect their company’s interests.

Here’s what you should keep in mind:

- You are not required to give a recorded statement.

- Avoid discussing injuries until you’ve seen a doctor. Some symptoms take time to appear.

- If you’re uncertain, direct them to your attorney or let them know you’ll respond in writing.

Document Everything Thoroughly

Strong evidence strengthens your claim. Gather and keep the following:

- Photos of the accident scene, vehicle damage, and injuries.

- Medical records detailing your treatment.

- A copy of the police report.

- Witness statements, if available.

Keeping a journal of how the accident affects your daily life can also be useful. Pain, mobility issues, emotional distress—these details could support your claim for fair compensation.

Don’t Rush Into a Settlement

Insurance companies often offer quick settlements. While it may seem tempting, these offers are usually much lower than what you actually need to cover medical bills, lost wages, and other damages.

Before accepting anything, consider:

- Have all injuries been fully treated?

- Are future medical expenses accounted for?

- Will this compensation truly cover all financial losses?

If there’s any doubt, seek legal advice before signing anything. Once you accept a settlement, you can’t ask for more later.

Get Legal Help if Needed

If the claims process becomes frustrating or if the insurance company is unfairly denying your claim, you don’t have to handle it alone. An experienced car accident lawyer can negotiate on your behalf and ensure your rights are protected.

Legal professionals understand the tactics insurance companies use. With their help, you stand a much better chance of receiving the compensation you deserve.

Final Thoughts

Dealing with insurance companies after a car accident isn’t easy, but being informed can make a world of difference. Stick to the facts, document everything, and don’t let them pressure you into settling too soon. If things get complicated, seeking legal guidance is always a smart move.

Your health and financial well-being should always come first. Stay patient, stay cautious, and make sure you get the support you need.

INSURANCE

Factors That Increase the Value of a Car Accident Claim

Car accidents can be a traumatic experience. Dealing with the legal aftermath can be even more stressful. People may be waiting to receive fair compensation to recover their losses. They should know there are some factors that can help increase the value of their car accident claim.

This article discusses everything that increases the total value of car accident compensation. If you are still unsure, you can contact Rawlins Law Accident & Injury Attorneys, who specialize in helping accident victims to ensure they receive maximum compensation.

Severity of Injuries and Medical Treatment

Your compensation depends on the injuries you experience during the accident. The worth of settlements increases dramatically if injuries surpass a specific threshold because of various combined factors.

- Comprehensive Medical Documentation: Medical documentation from healthcare professionals functions as verified evidence that shows your injuries. Detailed medical documentation serves as an essential requirement.

- Treatment Consistency:Medical advice from your doctor needs to be followed continuously to prove that your injuries exist. Insurance adjusters search for periods without medical care as a basis to prove your injuries are less serious than you describe. Your condition becomes clearer through regular doctor visits and proper therapy implementation.

- Long-term Impact: Claims for permanent disabilities together with scarring along with chronic pain typically receive greater compensation amounts. The inability to work alongside the loss of ability to enjoy life or perform daily activities creates higher claim value because these substantial life changes need appropriate financial support.

Liability Evidence and Documentation

The strength of evidence supporting the other driver’s fault directly impacts your claim value.

- Clear Fault Determination:Clear fault leads to increased payouts. The presentation of complete evidence through police reports and witness statements, together with photographs from accident scenes, provides unambiguous proof of responsibility, thus shielding your compensation from insurance company attempts to reduce payouts by attributing joint liability.

- Professional Accident Investigation:Experienced investigators use their expertise to discover important information that investigators without their background might fail to observe. Professional examination of accidents by reconstruction specialists allows you to build stronger evidence that lawyers can use for negotiation purposes.

Insurance Coverage Considerations

Available insurance coverage sets practical limits on potential compensation.

- Policy Limits: Owners of insurance policies define the highest compensation level that their carriers can provide. Serious claims require analyzing all potential insurance benefits as well as using the homeowner’s underinsured motorist coverage amount.

- Bad Faith Practices:Insurance companies must carry out their duties with complete honesty and fairness according to legal requirements. Your overall settlement amount may grow if insurance companies violate their duty to handle claims properly because this behavior could lead to bad faith penalties.

- Legal Representation Quality: Insurance claims succeed more often when victims work with attorneys who possess experience in this field.

- Negotiation Skills:Lawyers who possess insurance claims knowledge stand against insurance companies that try to offer low settlement amounts. Your compensation will be appropriate because your attorney uses their knowledge of similar cases and settlement patterns to stand for fair compensation.

Trial Experience

The presence of attorneys who have demonstrated trial competence gives insurance companies an additional reason to settle claims outside the courtroom. The risk of trial preparation convinces insurance companies to pay better settlements to cases. Your claim results significantly improve with proper legal counsel.

Conclusion

Identifying the main elements affecting claim value will enable you to develop proactive strategies when facing post-accident situations. Proper documentation, consistent medical treatment, and qualified legal representation are your most powerful tools for maximizing compensation.

-

TECHNOLOGY2 years ago

TECHNOLOGY2 years agoElevating Game Day Eats: A Guide to Crafting Crowd-Pleasing Sliders

-

ENTERTAINMENT2 years ago

ENTERTAINMENT2 years agowave_of_happy_: Your Ultimate Guide

-

FASHION2 years ago

FASHION2 years agoGPMsign Fashion: Redefining Style with Purpose

-

TECHNOLOGY2 years ago

TECHNOLOGY2 years agoTrader Joe’s Dayforce: Revolutionizing Workforce Management

-

FOOD2 years ago

FOOD2 years agoAltador Cup Food Court Background: A Culinary Extravaganza Unveiled

-

HOME IMPROVEMENT1 year ago

HOME IMPROVEMENT1 year agoWhat Kitchen Renovation Companies Offer Beyond Basic Remodeling

-

SPORTS2 years ago

SPORTS2 years agoScore Chaser Sporting Clays: A Thrilling Pursuit of Precision

-

NEWS2 years ago

NEWS2 years agoNyl2 Kemono: Unveiling the World