BLOG

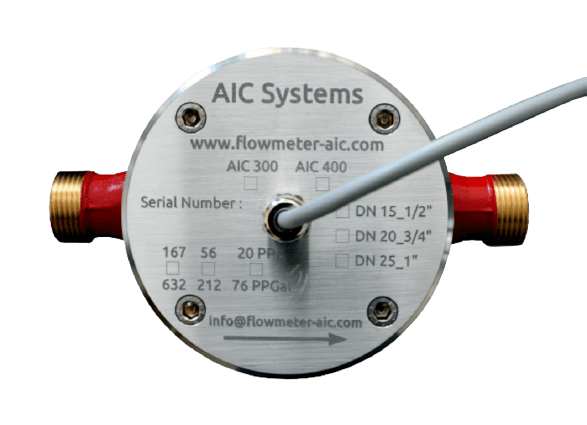

Why Positive Displacement Flow Meters Are Perfect for Precise Flow Measurement

In industries that rely on accurate fluid flow measurements, choosing the right flow meter is critical. Among the many options available, these meters stand out as one of the most reliable and precise choices. Whether you’re in oil and gas, chemical processing, food and beverage, or any other sector requiring accurate flow data, they offer unmatched performance.

What is a Displacement Flow Meter?

A positive displacement flow meter is a type of mechanical flow meter that measures the volume of fluid passing through a pipe by trapping fixed amounts of fluid and counting the number of times the fluid passes through. These meters function by dividing the flow into discrete, known volumes and using the movement of a mechanical component (like gears or pistons) to track the amount of fluid passing through. The key to their accuracy is the fact that each movement corresponds to a specific, measurable volume of fluid, ensuring precise flow measurements.

Key Features of Displacement Flow Meters

- Highly Accurate Measurement

One of the defining characteristics of these meters is their exceptional accuracy. Since the flow is physically divided into measurable segments, the readings are very precise, even at low flow rates. This makes them perfect for industries where even small variations in flow can have a significant impact. - Minimal Sensitivity to Fluid Properties

Unlike other flow meters that may be influenced by changes in viscosity, temperature, or density, these meters are largely unaffected by these properties. This makes them ideal for applications where fluid characteristics can vary, such as in the handling of oils, creams, or even slurry. - Wide Flow Range

These meters offer a wide flow measurement range, making them suitable for both low and high flow applications. This versatility ensures that businesses can rely on them across different operating conditions without compromising accuracy. - Mechanical Simplicity and Durability

These meters are relatively simple mechanically and consist of only a few moving parts. This simplicity leads to durability and long-lasting performance, especially when compared to more complex flow meters. With proper maintenance, they can provide years of service in tough environments.

Applications of Displacement Flow Meters

These meters are widely used in industries where accuracy is paramount, including:

- Oil and Gas: Measuring the flow of crude oil, refined products, and natural gas.

- Chemical Processing: Monitoring the flow of chemicals and liquids with varying viscosities.

- Food and Beverage: Ensuring accurate measurement of ingredients like milk, syrup, or oils in production lines.

- Pharmaceuticals: Assuring the right dosage and consistent flow of liquids during manufacturing.

Their accuracy makes them ideal for applications where small inaccuracies could lead to issues such as overfilling, underfilling, or inefficient production.

Benefits of Using Displacement Flow Meters

- Precision

These meters are considered one of the most precise types available, offering highly reliable data in a variety of settings. This is especially important for industries that must adhere to strict regulatory standards or require exact measurements for product consistency. - Cost-Effectiveness in the Long Run

Although these meters may have a higher initial cost compared to other types of flow meters, their durability and accuracy provide significant long-term savings. They reduce waste, optimize production processes, and minimize downtime, all of which contribute to improved operational efficiency. - Low Maintenance Requirements

Thanks to their mechanical design, these meters typically have fewer components that can fail, leading to lower maintenance costs. Routine maintenance is simple and ensures that the meter continues to deliver accurate readings over its lifespan.

Versatile in Different Environments

These meters are suitable for a variety of environments, including those with varying flow rates, temperature fluctuations, or fluid types. This versatility makes them an attractive option for businesses with diverse needs.

Why Choose Displacement Flow Meters?

For industries where flow measurement precision is critical, these meters offer a reliable solution. Their accuracy, durability, and ability to function under diverse conditions make them an ideal choice for businesses looking to maintain tight control over their fluid flows. When choosing the right flow meter, it’s essential to consider your specific needs and operational conditions, and for many industries, a positive displacement meter is the perfect fit.

With the ability to measure flows precisely and consistently, these meters ensure operational efficiency, compliance, and long-term cost savings. As industries continue to prioritize reliability and accuracy, the demand for these meters will only grow, solidifying their place as a go-to solution for precise flow measurement.

Conclusion

In conclusion, displacement flow meters from AIC Systems AG are a cornerstone of precision in flow measurement. Their ability to deliver highly accurate readings, even in challenging environments, makes them an essential tool for a wide range of industries. With their mechanical simplicity, durability, and low maintenance requirements, they provide long-term value and performance. For businesses seeking to improve efficiency, reduce waste, and ensure the quality of their products.

BLOG

Candizi: Exploring Its Meaning, Uses, and Growing Relevance in the Digital World

Candizi is an emerging term that has begun to capture attention in online searches, creative spaces, and digital conversations. In an era where originality and uniqueness matter more than ever, stands out as a flexible and adaptable keyword that can represent ideas, concepts, or even brand identities. This article provides a complete exploration of , explaining what it represents, how it is used, and why it continues to gain relevance across different digital environments.

Understanding the Concept of Candizi

Candizi does not belong to a single fixed definition, which is part of its appeal. It functions as a modern conceptual term that can be shaped according to context. For some, represents creativity and innovation, while for others it symbolizes a fresh digital identity. The openness of allows individuals and organizations to assign meaning based on their goals and audience.

The importance of lies in its versatility. Unlike traditional keywords that come with predefined associations, offers a clean slate. This makes it especially valuable in branding, content creation, and online storytelling where originality plays a crucial role.

The Evolution and Background of Candizi

The development of candizi reflects how language evolves in the digital age. Rather than originating from a historical or linguistic root, appears to have emerged organically through creative experimentation and online usage. Over time, repeated exposure and curiosity have given its growing presence.

As digital platforms continue to encourage unique identifiers, fits naturally into this evolution. It shows how modern terms can gain traction simply by being distinctive, memorable, and adaptable to multiple interpretations.

Candizi in Digital Creativity and Innovation

Creativity thrives on flexibility, and candizi provides exactly that. In creative industries, can be used as a project name, conceptual framework, or thematic identity. Because it does not limit interpretation, creators can build narratives, visuals, and strategies around it without restriction.

Innovation also benefits from terms like . When teams work on new ideas, having a neutral yet distinctive concept encourages open thinking. becomes a mental space where innovation can develop freely.

The Role of Candizi in Branding and Identity

Branding requires memorability, clarity, and originality. Candizi offers all three. Brands using can define their identity from scratch, ensuring that the keyword aligns perfectly with their vision and values. This level of control is difficult to achieve with commonly used terms.

The following table demonstrates how functions within branding contexts:

| Branding Aspect | How Candizi Fits | Outcome |

|---|---|---|

| Brand Naming | Unique and original term | Strong recognition |

| Identity Building | Flexible meaning | Clear positioning |

| Market Differentiation | No prior associations | Competitive advantage |

This table shows how supports long-term branding strategies while maintaining creative freedom.

Candizi and Its Appeal to Global Audiences

Candizi appeals to global audiences because it is linguistically neutral. It does not belong to a specific culture or language, which allows it to be adopted internationally without confusion. This global compatibility is essential in today’s interconnected digital world.

Another reason for its appeal is simplicity. is easy to pronounce, spell, and remember. These characteristics improve user engagement and make the keyword suitable for digital platforms, search engines, and social media.

Psychological Influence of Candizi on Users

Novelty plays a significant role in human attention, and candizi benefits from this psychological principle. When users encounter an unfamiliar yet pleasant-sounding term, curiosity is triggered. This curiosity often leads to deeper engagement, whether through searching, reading, or interaction.

also creates a sense of openness. Because it lacks a fixed definition, users feel invited to explore and interpret it. This emotional connection strengthens engagement and retention, particularly in creative or educational environments.

Candizi in Content Strategy and SEO

From an SEO perspective, candizi presents a valuable opportunity. As a unique keyword, it faces less competition while offering strong branding potential. Content creators can optimize articles, websites, and digital assets around without competing against oversaturated terms.

The table below highlights how performs in content strategy:

| SEO Element | Role of Candizi | Benefit |

|---|---|---|

| Keyword Competition | Low saturation | Easier ranking |

| Content Flexibility | Broad usage | Diverse topics |

| Search Intent | Curiosity-driven | Higher engagement |

This strategic advantage makes attractive for bloggers, marketers, and digital entrepreneurs.

Educational and Conceptual Uses of Candizi

In education, candizi can be used as a teaching tool to encourage abstract thinking. Educators can present as a concept and ask learners to define, expand, or apply it. This approach strengthens creativity, problem-solving skills, and conceptual understanding.

also works well in workshops, brainstorming sessions, and innovation labs. Its open nature removes limitations and allows participants to think freely without predefined constraints.

Challenges and Best Practices When Using Candizi

While candizi offers flexibility, clarity remains essential. Users should clearly explain what represents within their specific context. Without explanation, audiences may struggle to understand its relevance.

Consistency is another key factor. Once is defined within a project or brand, that meaning should remain stable across platforms. This consistency builds trust and recognition over time.

The Future Potential of Candizi

As digital communication continues to evolve, the relevance of adaptable keywords like candizi is expected to grow. With increasing demand for originality, has the potential to become a recognized concept in branding, creativity, and digital innovation.

Its ability to evolve alongside trends ensures longevity. can adapt to new technologies, platforms, and cultural shifts without losing relevance.

Final Thoughts on Candizi

Candizi represents the modern approach to language, creativity, and digital identity. Its flexibility, originality, and global appeal make it a powerful keyword for a wide range of applications. By understanding and using strategically, individuals and organizations can unlock new possibilities for expression and innovation.

As the digital world continues to value uniqueness, stands as a reminder that meanin

BLOG

Awius: Understanding the Concept, Meaning, and Modern Relevance of Awius

Awius is a term that has recently drawn attention in online searches and digital discussions, especially among users interested in emerging concepts, naming trends, and adaptable keywords. In an age where originality and uniqueness matter more than ever, stands out as a flexible and human-centered term. This article explores in detail, examining its meaning, potential interpretations, modern usage, and why it continues to gain relevance across different contexts.

What Is Awius and Why Does It Matter?

Awius can be described as a versatile keyword with no fixed limitation, allowing it to be shaped by usage and intention. Unlike traditional terms with strict definitions, functions as an open concept that can represent ideas, projects, systems, or digital identities. This flexibility is one of the key reasons has become appealing in modern communication.

The importance of lies in its adaptability. As digital platforms grow and competition for attention increases, unique terms like help individuals and brands create a distinct presence. Understanding means understanding how language evolves to support creativity and innovation.

The Background and Development of Awius

The development of awius is rooted in modern digital culture, where new words and terms often emerge without formal origins. appears to have grown organically, shaped by curiosity and repeated usage rather than strict linguistic rules. Over time, has gained recognition as a term that feels modern, neutral, and adaptable.

As more users encounter , they begin to associate it with originality and forward thinking. This gradual development shows how meaning can be created collectively, making a living example of language evolution in the digital age.

How Awius Is Used in Today’s Digital Environment

In today’s digital environment, awius is commonly used as a conceptual or identity-based keyword. It may appear as a project name, a creative label, or a framework for organizing ideas. Because does not carry strong predefined associations, it allows users to assign meaning that aligns with their goals.

This adaptability makes especially valuable in online spaces where branding, memorability, and clarity are essential. Whether used in content creation, digital platforms, or experimental ideas, provides room for growth and reinterpretation.

Awius and Its Role in Branding and Identity

Awius has strong potential as a branding and identity tool. Modern brands often seek names that are unique, easy to remember, and flexible enough to grow with the business. meets these criteria by offering originality without complexity.

The following table explains how functions in branding contexts:

| Branding Aspect | Use of Awius | Impact |

|---|---|---|

| Brand Naming | Unique identifier | Strong differentiation |

| Identity Building | Flexible meaning | Long-term adaptability |

| Audience Recall | Simple structure | Improved memorability |

This table shows how supports brand development while allowing creative freedom.

Awius in Technology and Innovation

In technology-driven spaces, awius is often associated with innovation and experimentation. Developers, designers, and digital creators prefer adaptable terms that do not limit future expansion. works well in this context because it can represent evolving systems, tools, or ideas.

As technology changes rapidly, having a term like allows for continuous redefinition. This makes it suitable for startups, digital platforms, and conceptual frameworks that may shift over time.

Psychological Appeal of Awius

From a psychological perspective, awius benefits from novelty and neutrality. Humans are naturally drawn to unfamiliar yet approachable terms. sounds balanced and modern, which encourages curiosity and exploration.

When users encounter , they are more likely to pause and consider its meaning. This moment of curiosity increases engagement and emotional connection, especially in digital content and branding environments.

Awius in Creative and Educational Contexts

In creative fields, awius acts as a blank canvas. Writers, artists, and designers can use as a theme or project name without being constrained by existing meanings. This freedom encourages originality and experimentation.

Educational environments also benefit from . Educators can use it as an example of abstract thinking, asking students to define, interpret, or expand upon its meaning. This approach strengthens critical thinking and creativity.

The table below illustrates how is applied in creative and educational settings:

| Context | Application of Awius | Result |

|---|---|---|

| Creative Projects | Conceptual title | Enhanced originality |

| Education | Abstract example | Improved critical thinking |

| Workshops | Idea framework | Flexible learning structure |

Challenges of Using Awius Effectively

While awius offers flexibility, it also requires clarity. Because the term does not have a fixed meaning, users must clearly explain what represents in their specific context. Without explanation, audiences may feel uncertain or confused.

Consistency is another important factor. Once is defined within a project or brand, that definition should remain stable across platforms. This consistency helps build trust and recognition over time.

Awius and Search Engine Optimization

From an SEO perspective, awius works well as a focus keyword because of its uniqueness. Low competition and high distinctiveness make it easier to rank when optimized correctly. However, responsible usage is essential to maintain natural readability.

Using strategically in titles, headings, and content allows search engines to understand relevance while still providing value to human readers. When balanced correctly, supports both discoverability and user engagement.

The Future Potential of Awius

The future of awius appears promising as digital culture continues to favor originality and adaptability. As more platforms emerge and naming competition increases, terms like will become even more valuable.

has the potential to evolve alongside technology, creativity, and communication trends. Its open-ended nature ensures that it can remain relevant regardless of changes in industry or audience expectations.

Final Thoughts on Awius

Awius represents more than a keyword; it reflects how modern language adapts to human creativity and digital growth. Its flexibility, simplicity, and global neutrality make it suitable for a wide range of applications. Whether used in branding, education, technology, or creative exploration, provides a foundation for innovation.

By understanding and using thoughtfully, individuals and organizations can create meaningful connections and stand out in an increasingly crowded digital landscape. is a reminder that sometimes, the most powerful ideas begin with an open definition and human imagination.

BLOG

How to Use Floral Wallpaper to Refresh Your Interior

Thinking about giving your space a fresh look? Paint is fine, and plain wallpaper can work—but floral wallpaper might just be the easiest way to add life, charm, and personality to any room. It’s not only pretty; it can also completely transform how your home feels. Whether you’re aiming for cozy, dramatic, or bright and breezy, floral designs can help you get there.

Many homeowners are also drawn to materials with a tactile feel. Some, like natural fiber wallpaper, add layers and warmth to walls. They add depth and warmth. This feel works well with floral designs.

Why Floral Wallpaper Still Works

Floral patterns have been around for centuries, and they keep coming back for good reason. They’re versatile. Floral prints come in many looks. Some are small and vintage. Others are big and modern. So whatever your style is, there’s a floral print that will work.

They also bring nature indoors. In a time when we spend so much time inside, being surrounded by organic patterns and soft lines makes a big difference. A room with a nature-inspired design tends to feel more relaxing and lived-in.

And forget the old-fashioned stigma. Today’s floral wallpaper is nothing like your grandmother’s. It’s bold, sophisticated, and often used by top interior designers. You can find it in high-end hotels, restaurants, and editorial-style homes.

Where to Use Floral Prints

You don’t have to go all-in to enjoy the impact of floral wallpaper. Even one accent wall can shift the mood of a room. Here’s how different rooms can benefit:

Best Rooms for Floral Wallpaper:

- Bedrooms– Use soft florals in calming colors for a restful, cozy feel.

- Living rooms– A large-scale floral print behind the sofa can act like artwork.

- Bathrooms– Powder rooms are perfect for trying bold florals.

- Dining areas– Floral wallpaper creates a more welcoming and vibrant space.

Matching Floral Wallpaper with Other Styles

Floral wallpaper blends surprisingly well with other textures and elements. For instance, try mixing it with rattan furniture, metal finishes, or even concrete for a layered look. Pairing it with floral wallpaper from a trusted collection helps ensure good quality and a pattern that fits your vision.

If you love farmhouse or cottagecore interiors, small blossoms in soft colors work well. For modern homes, look for abstract or oversized flowers with strong contrast. Dark floral wallpaper works great in dramatic, moody spaces like a reading nook or a dining room with rich woods.

Tips to Keep It Balanced

Floral wallpaper is expressive, so it’s important to keep the rest of the room balanced. If your wall pattern is busy, go light on furniture details and colors. Simple shapes and neutral tones help the wallpaper shine without overwhelming the room.

Good lighting makes a big difference too. Natural light softens florals during the day, while warm indoor lighting adds coziness in the evening. Don’t forget—wallpapers with metallic details can reflect light beautifully, adding even more depth to the space.

Pros and Cons to Consider

Like any design choice, floral wallpaper comes with a few things to weigh.

Pros:

- Instantly adds personality and mood to a space

- Works with many styles from vintage to modern

- Helps define the function of a space (like a reading corner or vanity wall)

- Huge variety of colors, scales, and designs

- Easy to use in both bold and subtle ways

Cons:

- Can overwhelm small spaces if used on all walls

- Might require professional installation depending on the material

- Needs thoughtful coordination with furniture and decor

How to Start Small

If you’re unsure, don’t commit to a whole room. Try using floral wallpaper on:

- Just one feature wall

- The back of shelves or cabinets

- A hallway or entryway

- Inside a closet or wardrobe for a hidden surprise

Peel-and-stick versions are great if you’re renting or just want to try it out first. And if you’re feeling creative, you can even frame sections of wallpaper like art.

Final Thoughts

Floral wallpaper is more than a decorative trend—it’s a design tool. It helps you tell a story in your space. It brings movement, softness, and nature into rooms that otherwise might feel too plain or flat.

With so many options in scale, color, and style, it’s easy to find one that fits your personality and your home. Whether you go for subtle pastels or bold botanicals, you’ll be surprised by how much life a few flowers can bring to your walls.

-

TECHNOLOGY2 years ago

TECHNOLOGY2 years agoElevating Game Day Eats: A Guide to Crafting Crowd-Pleasing Sliders

-

ENTERTAINMENT2 years ago

ENTERTAINMENT2 years agowave_of_happy_: Your Ultimate Guide

-

FASHION2 years ago

FASHION2 years agoGPMsign Fashion: Redefining Style with Purpose

-

TECHNOLOGY2 years ago

TECHNOLOGY2 years agoTrader Joe’s Dayforce: Revolutionizing Workforce Management

-

FOOD2 years ago

FOOD2 years agoAltador Cup Food Court Background: A Culinary Extravaganza Unveiled

-

HOME IMPROVEMENT1 year ago

HOME IMPROVEMENT1 year agoWhat Kitchen Renovation Companies Offer Beyond Basic Remodeling

-

SPORTS2 years ago

SPORTS2 years agoScore Chaser Sporting Clays: A Thrilling Pursuit of Precision

-

NEWS2 years ago

NEWS2 years agoNyl2 Kemono: Unveiling the World